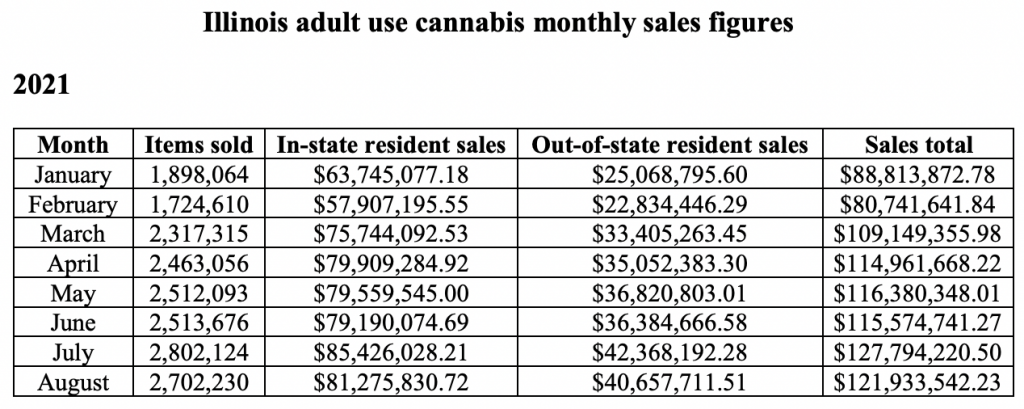

Adult-use marijuana sales in Illinois exceeded $120 million in August, state officials reported on Thursday. It’s the second highest sales record since the state’s recreational market launched last year and the sixth month in a row that sales surpassed $100 million.

Illinois saw $121,933,542 in cannabis purchases last month, with $81,275,830 coming from in-state residents and $40,657,711 from out-of-state visitors. The total sales is slightly lower compared to July’s nearly $128 million haul, but retailers had partially attributed the record-breaking sales that month to the music festival Lollapalooza.

Data from the state’s Department of Financial and Professional Regulation (IDFPR) has revealed how the adult-use market has evolved since retailers opened up—with sales consistently trending upward even in spite of the coronavirus pandemic.

Via IDFPR.

All told, consumers bought 2,702,230 individual recreational marijuana items in August. The new figures do not include sales of medical cannabis, which are tracked separately by a different agency.

If the trend continues, the state is on track to see more than $1 billion in adult-use marijuana sales in 2021.

That would mean a significant increase revenue for the state. Illinois sold about $670 million in cannabis last year and took in $205.4 million in tax revenue.

Illinois took in more tax dollars from marijuana than alcohol for the first time last quarter, the state Department of Revenue reported in May. From January to March, Illinois generated about $86,537,000 in adult-use marijuana tax revenue, compared to $72,281,000 from liquor sales.

In July, state officials put $3.5 million in cannabis-generated funds toward efforts to reduce violence through street intervention programs.

Wisconsin Gov. Tony Evers (D) is getting “tired” of hearing about these sales figures, he said in April, joking that Illinois Gov. J.B. Pritzker (D) always “thanks me for having Wisconsinites cross the border to buy marijuana” since the neighboring state does not have a legal market.

Illinois officials have emphasized that the tax dollars from all of these sales are being put to good use. For example, the state announced in January that it is distributing $31.5 million in grants funded by marijuana tax dollars to communities that have been disproportionately impacted by the war on drugs.

The funds are part of the state’s Restore, Reinvest, and Renew (R3) program, which was established under Illinois’s adult-use cannabis legalization law. It requires 25 percent of marijuana tax dollars to be put in that fund and used to provide disadvantaged people with services such as legal aid, youth development, community reentry and financial support.

Awarding the new grant money is not all that Illinois is doing to promote social equity and repair the harms of cannabis criminalization. Pritzker announced in December that his office had processed more than 500,000 expungements and pardons for people with low-level cannabis convictions on their records.

Relatedly, a state-funded initiative was recently established to help residents with marijuana convictions get legal aid and other services to have their records expunged.

But promoting social equity in the state’s cannabis industry has proved challenging. Illinois has faced criticism from advocates and lawsuits from marijuana business applicants who feel officials haven’t done enough to ensure diversity among business owners in the industry.

Pritzker’s signed a bill in July that’s meant to build upon the state’s legalization law by creating more cannabis business licensing opportunities to help people from disproportionately impacted communities enter into the marijuana industry. Regulators are now holding a series of lotteries to award additional dispensary licenses.

Meanwhile, a House committee approved a resolution earlier this year that broadly condemns the war on drugs, calling it “the United States’ longest and costliest war and ultimately a complete and shameful failure.”

Cannabis sales have been going strong is markets across the U.S.

For example, the Massachusetts Cannabis Control Commission reported on Wednesday that marijuana purchases have topped $2 billion since the state’s adult-use market launched in late 2018.

Arizona brought in about $21 million in medical and adult-use marijuana tax revenue in July, state officials recently reported on a new webpage that enables people to more easily track how the industry is evolving.

California collected about $817 million in adult-use marijuana tax revenue during the 2020-2021 fiscal year, state officials estimated last week. That’s 55 percent more cannabis earnings for state coffers than was generated in the prior fiscal year.

A recent scientific analysis of sales data in Alaska, Colorado, Oregon and Washington State found that marijuana purchases “have increased more during the COVID-19 pandemic than in the previous two years.”

In July alone, at least three states saw record-breaking sales for recreational cannabis. The same goes for Missouri’s medical marijuana program.

Beside Illinois, adult-use marijuana sales in Maine reached $9.4 million in July—a 45 percent increase from the prior month’s record.

Michigan marijuana sales broke another record in July with more than $171 million in cannabis transactions, according to data from the state’s regulatory body. There were $128 million in adult-use sales and $43 million in medical cannabis purchases.

Throughout the pandemic, many states allowed cannabis retailers to remain open—with governors and regulators in several markets declaring marijuana businesses to be essential services—and some jurisdictions issued emergency rules allowing curbside pickup, delivery services or other more relaxed policies in order to facilitate social distancing.

House Committee Orders Pentagon To Review Racially Discriminatory Drug Testing Of Military Personnel

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.