(This is a contributed guest column. To be considered as an MJBizDaily guest columnist, please submit your request here.)

Cannabis capital markets have faced significant challenges over the past few years.

As investors who have been actively involved in the industry since 2019, we have had the privilege of experiencing every market cycle – from euphoric highs to sobering lows.

Despite these fluctuations, today’s market environment presents an unparalleled opportunity for discerning investors, thanks to unique deal structures, compelling valuations and the ability to identify and back exceptional management teams.

Challenges and opportunities

The marijuana industry’s struggles with access to capital have fundamentally reshaped the competitive landscape.

Over the past two years, funding sources have dried up, leaving many companies to adapt or face extinction.

This environment has proved to be a litmus test for management teams.

Companies that relied on continuous funding to mask operational inefficiencies are no longer able to do so.

In this Darwinian scenario, two distinct categories have emerged:

• Resilient operators: These companies have tightened their belts, embraced discipline and demonstrated the ability to run profitable, sustainable businesses.

Great management shines in difficult environments, and these teams are proving their worth by achieving profitability and navigating complexities with skill.

• Distressed assets: On the other end of the spectrum are companies that have faltered under the weight of market pressures.

While this presents challenges for some, it also creates opportunities for investors to acquire distressed assets at significant discounts, enabling potential turnarounds or strategic value plays.

Historical parallels

Warren Buffett’s well-known adage – “Be fearful when others are greedy and greedy when others are fearful” – resonates deeply in today’s cannabis markets.

Fear and uncertainty dominate the space, creating an environment ripe for those willing to take calculated risks.

History teaches us that vintages born out of adversity often yield the most rewarding outcomes.

We believe this vintage of the cannabis sector is poised for success.

Macroeconomic tailwinds

The cannabis industry also is benefiting from several macro-level tailwinds:

• Expanding market opportunity: More states than ever are authorizing medical and recreational cannabis, bringing to 41 the total number of markets with some form of marijuana reform.

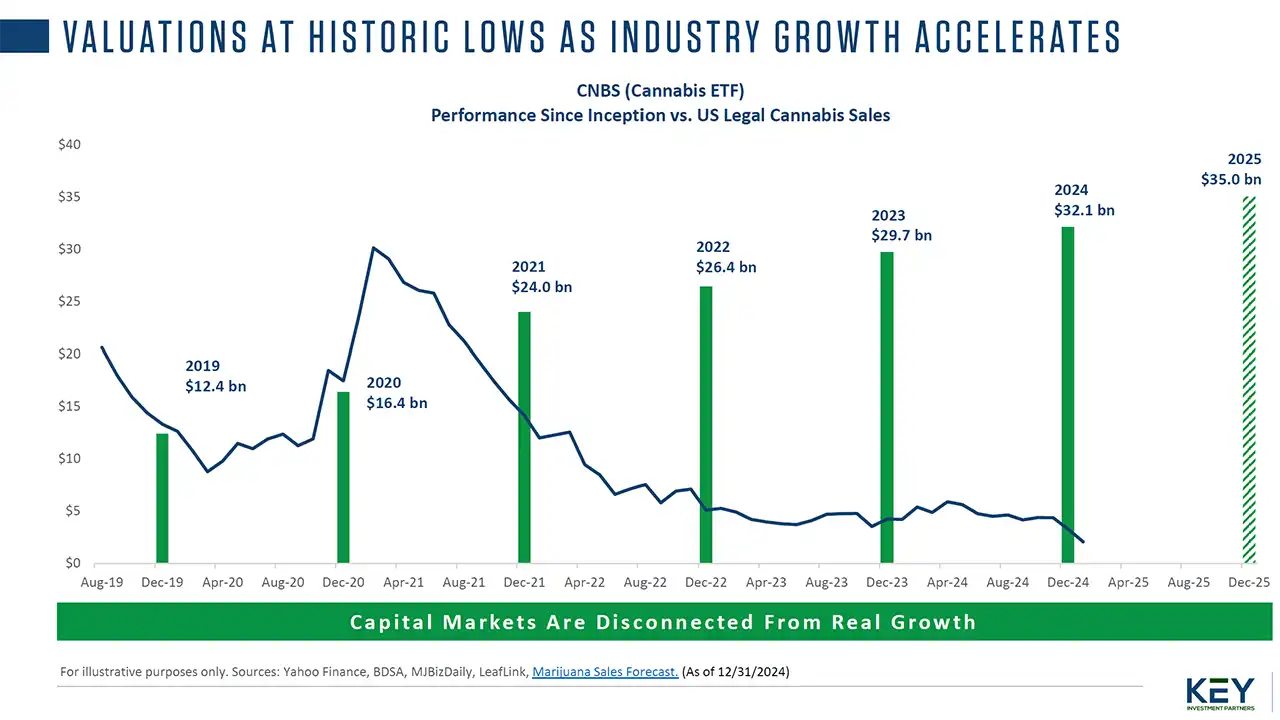

According to Oregon-based Whitney Economics, the regulated marijuana market in the United States increased by $2.6 billion in 2024, to $31.4 billion and is expected to grow 12.1% in 2025, to $35.2 billion.

• Policy progress: Bipartisan support for marijuana reform is gaining momentum.

The recent movement around SAFE Banking and federal rescheduling signal a turning point.

Reclassifying marijuana from Schedule 1 to Schedule 3 of the Controlled Substances Act would drastically reduce tax burdens on cannabis businesses by alleviating the constraints of Section 280E, potentially improving profitability across the industry.

• Evolving consumer trends: Cannabis consumption continues to normalize, with the Pew Research Center reporting that an overwhelming 88% of Americans say marijuana should be legal for medical or recreational use.

This cultural shift underpins the long-term growth potential of the industry.

Right time to deploy capital

Investors often are lured by the allure of rising markets, but true opportunities lie in environments such as today’s.

Valuations have reset to more rational levels, and deal structures now favor investors.

Furthermore, the maturation of the industry means that many operators have a clearer path to profitability.

EV/revenue multiples for U.S. marijuana operators have dropped to some of the lowest levels we’ve seen in both the public and private markets (in many cases trading from all-time highs of ~6X to ~1X today).

Additionally, the potential for federal reform creates a significant upside.

SAFE Banking or rescheduling would act as catalysts, further legitimizing the industry and opening doors to institutional capital, which has largely remained on the sideline.

The combination of favorable valuations, disciplined operators and potential legislative breakthroughs sets the stage for outsized returns.

Inflection point

While the challenges of the past few years have been formidable, they also have created opportunities for those willing to navigate the complexities.

With more states embracing regulated marijuana markets, bipartisan support for reform and management teams demonstrating resilience, 2025 has all the ingredients for success.

As we look ahead, we see a unique convergence of factors that make this an ideal time to invest.

The marijuana capital markets might have been difficult, but the opportunities they present today are too compelling to ignore.

By investing now, we believe we are not only capitalizing on favorable conditions but also contributing to the growth of an industry poised to thrive in the years to come.

Tiby Erdely is a founding partner at Key Investment Partners, a Denver firm that provides institutional-quality investment management for the cannabis industry. He can be reached at tiby@keyinvestmentpartners.com.

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.