The U.S. Treasury Department has formally sent the White House its proposal to start collecting data on marijuana businesses from banks—alongside industries it already tracks like liquor stores, convenience stores, casinos and car dealers—as part of its ongoing efforts to combat money laundering activities.

In a notice published in the Federal Register late last week, Treasury’s Office of the Comptroller of the Currency (OCC) said that it has completed initial procedural steps on the plan, and it will be accepting a final round of public comments as the White House Office of Management and Budget (OMB) conducts a review.

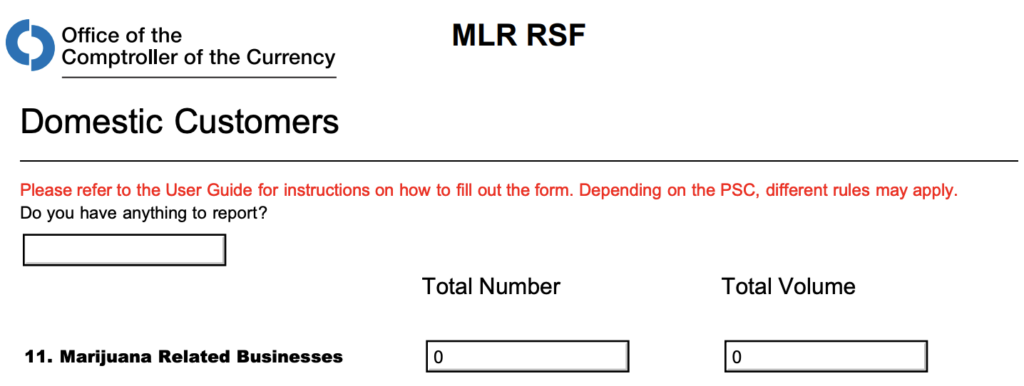

OCC first announced the proposal in June, saying it plans to track marijuana businesses as part of an annual Risk Summary Form (RSF) that needs to be filed by financial institutions. It’s viewed as another sign of the federal government’s recognition of the state-legal cannabis market, even as marijuana remains a federally controlled substance.

“The RSF collects data about different products, services, customers, and geographies (PSCs),” the latest notice says. To that end, Treasury said it wants to add “marijuana-related businesses” to the list of markets it monitors, as well as five other new categories such as crypto assets and ATM operators.

Via OCC.

The department said that its Money Laundering Risk System “enhances the ability of examiners and bank management to identify and evaluate” risks that are “associated with banks’ products, services, customers, and locations.”

With the emergence of new products and services, “banks’ evaluation of money laundering and terrorist financing risks should evolve as well.” Therefore, by making these changes to its data collection process, the agency said it will be better able to “identify those institutions, and areas within institutions, that may pose heightened risk and allocate examination resources accordingly.”

A final public comment period on the proposed changes is open through October 11.

In August, the National Cannabis Industry Association (NCIA) submitted a comment following the proposal’s initial announcement. It said that the organization is “pleased to see the OCC recognize the impact marijuana-related businesses are having on our financial system.”

NCIA said it supports the department’s “endeavor to improve data collection on this relatively new sector, increase transparency into the industry for regulators, and help reduce some of the administrative burden on banks so that more institutions will choose to service the industry.”

“Challenges resulting from the lack of banking are not limited to cannabis businesses, but also impact entities that choose to engage with and service them; including financial institutions themselves. Consequently, the MLR risk assessment is an important tool for the OCC’s Bank Secrecy Act/Anti-Money Laundering and OFAC supervision activities because it allows the agency to better identify those institutions, and areas within institutions, that may pose heightened risk and allocate examination resources accordingly.”

It’s not immediately clear how the information collected on the RSF—which if approved will ask financial services providers to report both the number of their marijuana business accounts and their overall volume—is analyzed or disseminated by OCC after being submitted by banks, but the new notice says the data allows the agency to “better identify those institutions, and areas within institutions, that may pose heightened risk and allocate examination resources accordingly.”

Information on the number of financial institutions that work with cannabis-related businesses is already reported through Suspicious Activity Reports (SARs) that banks and credit unions are required to submit under existing guidance, and Treasury’s Financial Crimes Enforcement Network (FinCEN) publicly releases that data on a quarterly basis.

The number of banks that report working with marijuana businesses ticked up again near the end of 2021—with 755 banks and credit unions having submitted the relevant reported as of September 30, 2021—according to FinCEN’s latest update in March.

As Congress works to advance legislation to end federal cannabis prohibition and reform banking policies related to the marijuana industry, the government has tacitly acknowledged and normalized its existence despite the fact that cannabis remains a Schedule I drug under the Controlled Substances Act.

For example, the U.S. Census Bureau announced last year that it would begin collecting and compiling data on revenue that states generate from legal marijuana.

The move—to add a cannabis question to annual reports that states submit—builds upon a separate notice the federal agency posted last year that explained it would be incorporating state-level cannabis tax data in its quarterly reports.

Meanwhile, in 2021 the U.S. Economic Classification Policy Committee—which is comprised of the White House Office of Management and Budget, the Census Bureau, the Bureau of Economic Analysis and the Bureau of Labor Statistics—recommended a policy change to include cannabis businesses as an official designation in the the North American Industry Classification System (NAICS), which is used to categorize and compile employment and market data on industries across the U.S., Mexico and Canada.

Atlanta Lawmakers Discuss Psychedelics Decriminalization Resolution

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.