A bipartisan coalition of two dozen governors is urging congressional leaders to finally enact marijuana banking reform through large-scale defense legislation.

In a letter sent to top lawmakers in the House and Senate on Tuesday, the state officials said the Secure and Fair Enforcement (SAFE) Banking Act should be attached to the must-pass National Defense Authorization Act (NDAA). The House has already approved its version and included the banking legislation, but it’s uncertain if the Senate will follow suit.

Colorado Gov. Jared Polis (D) led the letter, which is also signed by the governors of 22 other states and territories, along with Washington, D.C.’s mayor.

It states that the SAFE Banking Act “will allow cannabis businesses to access normal banking services, which will transition fully cash-based cannabis transactions into the financial system where they belong.”

“Thirty-seven states, four U.S. territories, and the District of Columbia have passed some form of recreational or medical cannabis legalization measures,” the governors wrote. “Medical and recreational cannabis sales in the U.S. were estimated to total $17.5 billion last year, but because of antiquated federal banking regulations, almost all cannabis transactions are cash-based.”

Rep. Ed Perlmutter (D-CO) is the chief sponsor of the House standalone banking bill, which would protect financial institutions that service state-legal marijuana businesses from being penalized by federal regulators. It’s passed the chamber in one form or another five times so far along largely bipartisan lines.

“Not only are cash-only businesses targets for crime, cannabis businesses are further disadvantaged compared to other legal businesses by being unable to open bank accounts or obtain loans at reasonable rates,” the letter states. “The cannabis industry is legal in some form in the majority of U.S. states and it is too large of a market to be prohibited from banking opportunities.”

“The SAFE Banking Amendment will remedy these harms and help keep communities in our states and territories safe by allowing legitimate and legal cannabis companies to access banking services. Financial institutions will subject the funds and account holders to rigorous anti-money laundering and ‘Know Your Customer’ requirements that will further help states where cannabis has been made legal to keep bad actors out of the system. The SAFE Banking Amendment will also harmonize federal and state law to ensure that depository institutions that provide banking services to legitimate cannabis-related businesses and ancillary businesses are not penalized.”

But the governors’ call for marijuana banking reform is notable for a few reasons.

First, it’s the latest development in an ongoing debate about cannabis policy priorities in Congress, where some members, particularly in the Senate, have insisted on passing comprehensive legalization first before enacting something that’s viewed as largely favorable to the industry.

Second, the state officials are specifically asking that the reform be included in the NDAA, which is viewed as a potentially more feasible vehicle compared to getting the standalone SAFE Banking Act approved through the Senate.

Senate Majority Leader Chuck Schumer (D-NY), who is championing a legalization bill that’s will be formally introduced soon and strongly favors holistically ending prohibition before putting banking on the floor, has left the door open to approving the more modest policy change through the NDAA as long as some social equity components are attached.

The governor of Schumer’s state, Gov. Kathy Hochul (D), is among the signatories on the new letter.

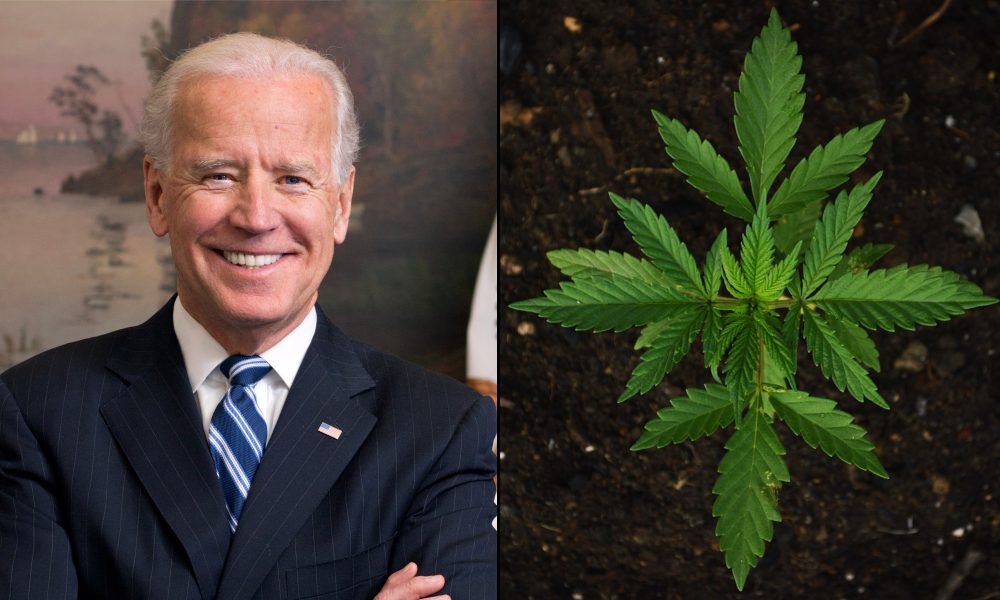

“Simply put, this is a public safety issue that Congress has a responsibility to address. The SAFE Banking Act has now passed the U.S. House of Representatives five times but the Senate has never voted on the measure,” the governors wrote. “The SAFE Banking Act has more bipartisan support than ever before and Congress must take steps to ensure that this measure is included in the final version of the NDAA that goes to President Biden’s desk.”

Again, however, there’s some debate among lawmakers and advocates about whether banking should be advanced first before Congress comprehensively ends prohibition and enacts policies that center social justice.

Sen. Cory Booker (D-NJ), who is working alongside Schumer on the legalization bill that’s being finalized, has made clear he intends to put up a fight if the Senate moves to pass the SAFE Banking Act first.

Booker’s home state governor, Gov. Phil Murphy (D), also signed the new letter calling for immediate action on cannabis banking.

Other signatories on the letter include the bipartisan governors of Alaska, California, Connecticut, Guam, Illinois, Maine, Massachusetts, Michigan, Minnesota, Nevada, New Mexico, North Dakota, Oregon, Pennsylvania, Rhode Island, U.S. Virgin Islands, Utah, Virginia, Washington State and Wisconsin.

“It’s time for Congress to allow cannabis-related businesses to have better access to the banking system and operate with normal bank accounts,” Polis, the Colorado governor, said in a press release. “After years of cannabis being legal in a multitude of states, it is long overdue for cannabis businesses to finally financially operate alongside other businesses in the open national banking system.”

A group of small marijuana business owners also recently made the case that the incremental banking policy change could actually help support social equity efforts.

Rodney Hood, a board member of the National Credit Union Administration, wrote in a Marijuana Moment op-ed last month that legalization is an inevitability—and it makes the most sense for government agencies to get ahead of the policy change to resolve banking complications now.

Meanwhile, an official with the Internal Revenue Service said last month that the agency would like to “get paid,” and it’d help if the marijuana industry had access to banks like companies in other legal markets so they could more easily comply with tax laws.

Federal data shows that many financial institutions remain hesitant to take on cannabis companies as clients, however, which is likely due to the fact that the plant is a strictly controlled substance under federal law.

Read the letter from the governors on congressional marijuana banking legislation below:

Biden Administration Will Keep Denying Public Housing Over Marijuana Despite Congresswoman’s Request

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.