“We recognize banking access is only one part of the problem facing minority cannabis businesses today. But let’s start somewhere and get done now what we can.”

By Frederika McClary Easley, The People’s Ecosystem

In February, the U.S. House of Representatives for a sixth time passed the Secure and Fair Enforcement (SAFE) Banking Act—this time attached to the America COMPETES Act, the comprehensive package aimed at enhancing U.S. leadership in science, innovation and competitiveness.

The purpose of the legislation is to protect banks from money laundering charges for providing loans and other financial services to state-legal cannabis businesses. Many argue that the passing of the SAFE Banking Act is a matter of health and safety due to the large amounts of cash that businesses are forced to have on hand and the lack of access to traditional loans.

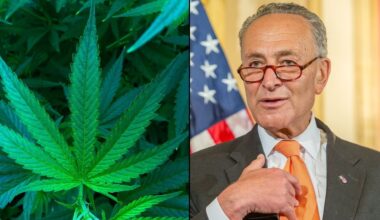

Senate Majority Leader Chuck Schumer (D-NY) and Sens. Cory Booker (D-NJ) and Ron Wyden (D-OR)—who are working to introduce the Cannabis Administration Opportunity Act (CAOA)—have expressed the need for a comprehensive approach. And Sen. Sherrod Brown (D-OH), who chairs the Senate Banking Committee, has shared his preference to have the SAFE Banking Act paired with drug sentencing reform.

The People’s Ecosystem, a 70 percent BIPOC-, women- and LGBTQ-owned and led business that successfully transitioned from the legacy to the regulated industry, has experienced firsthand the danger and inconvenience, and has been subject to predatory practices with financial institutions.

Our dispensary was physically damaged by a vehicle intentionally being driven into it during a robbery attempt. We have had to deal with up to 40 percent interest rates for loans and have had accounts closed more times than we can count. Harm is being repurposed and specifically disparately impacting social equity entrepreneurs. Not addressing this issue and instead choosing to play political games is perpetuating barriers to capital and economic services. That’s why The People’s Ecosystem is in support of the SAFE Banking Act.

We recognize there are still major disparities in our banking system felt by Black, Latinx and indigenous patrons. Data shows that Black-owned businesses are twice as likely to be denied financing, and if loans are approved, they are also more likely not to receive the full amount for which they applied.

Black, Latinx and indigenous individuals and communities that have historically been discriminated against in the banking system need protection from biased decision-making individuals and structures, guidance with navigating the lending process and preparation in order to receive sought-after outcomes. Accountability measures must be married with timelines and a scope that ensures that the intended people and communities which are owed harm repair are the actual recipients of funds and other financial allowances.

The SAFE Banking Act acknowledges the existence of inequality through its language mandating diversity and inclusion reports and a study to be conducted by the Government Accountability Office. While those measures do not go far enough to address the issue, it is a step in the direction toward righting the wrongs of the past.

We appreciate Sen. Brown’s position that the SAFE Banking Act bill needs to be inclusive of sentencing reform and we look forward to working with Sens. Schumer, Booker and Wyden on their comprehensive bill; however, we need immediate relief.

There are BIPOC business owners right now who are paying exorbitant interest rates on loans for standard operating needs or legal business owners who cannot open a bank account—even for non-plant touching operations. Sixty votes are needed in the Senate for CAOA or any other sort of cannabis reform legislation. The votes don’t appear to be there to pass a broader bill, but we can’t let perfect be the enemy of the good.

We recognize banking access is only one part of the problem facing minority cannabis businesses today. But let’s start somewhere and get done now what we can. We need access to the banking system now as we continue the fight for social equity and sentencing provisions, broader banking service for all minority businesses and greater education and accountability measures.

Quite simply, SAFE Banking is social equity! Banking access and a huge step forward on federal cannabis reform that will catapult our country into a much-needed conversation around cannabis reform and kickstart broader, more comprehensive reforms.

To Sens. Schumer, Booker, Wyden and Brown: to continue to block the SAFE Banking Act is to be against social equity and thousands of state-legal businesses in your states and across the country who desperately need help. Please pass SAFE Banking as soon as possible.

Frederika McClary Easley is the Director of Strategic Initiatives at The People’s Ecosystem and host of The People are Blunt podcast.

Delaware Senate Approves Marijuana Legalization Bill, Sending It To The Governor

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.