Illinois’s marijuana market seems to be rebounding after a couple of months of lagging sales, with officials reporting on Monday that the state saw nearly $131 million in legal recreational cannabis purchases last month.

That’s the second highest recorded sales month for adult-use marijuana since the industry opened in 2020.

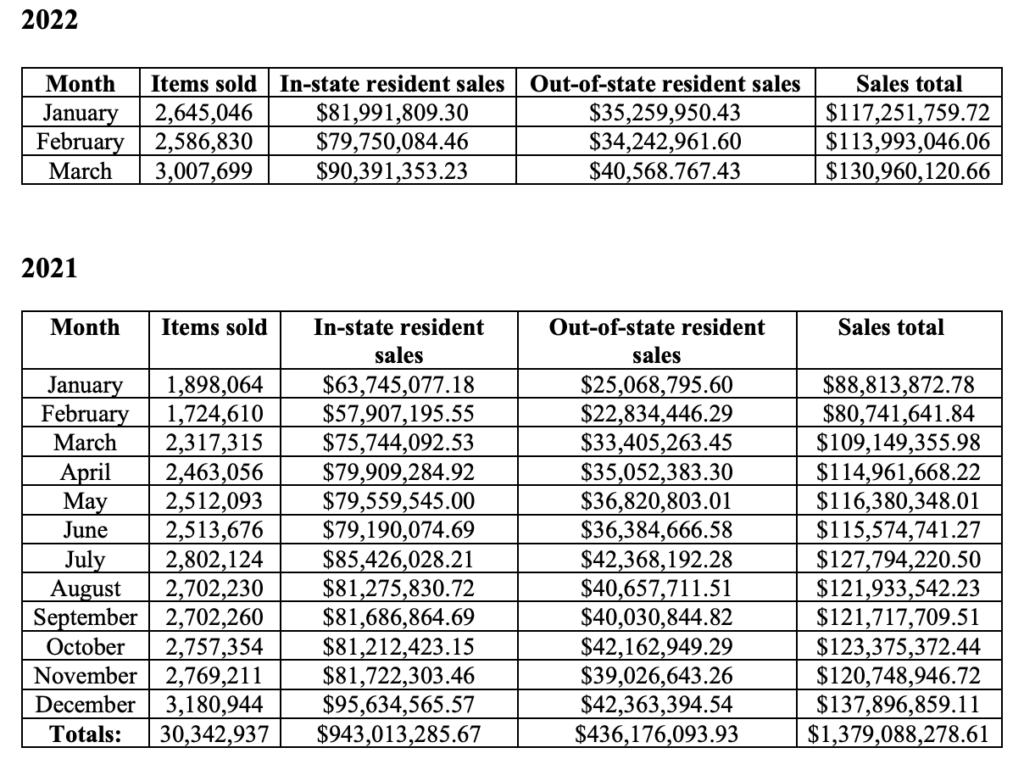

The Illinois Department of Financial and Professional Regulation (IDFPR) reported that there were almost $90.4 million in adult-use cannabis sales from in-state consumers last month, while about $40.6 million came from out-of-state visitors. A total of 3,007,699 individual marijuana items were sold in March.

Via IDFPR.

The totals don’t include medical cannabis products, which are reported separately by a different state agency.

While Illinois broke its yearly record for cannabis sales in 2021—with more than $1.4 billion in cannabis sold last year—marijuana purchases dipped in January and February, following the December 2021 record-high of $137,896,859.

From last year’s sales, Illinois generated almost $100 million more in tax revenue from adult-use marijuana sales than from alcohol in 2021, state data found.

It’s unclear what factors may have contributed to the dip at the beginning of this year, or the rebound in March.

Meanwhile, an Illinois Senate committee recently debated a bill that would protect workers from being fired for using cannabis on their free time. With some exceptions, the measure would prohibit employers from firing workers or discriminating against job applicants merely for testing positive for marijuana use.

—

Marijuana Moment is already tracking more than 1,000 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

But the bill sponsor pulled the measure following committee the debate, saying he would return to it later. The state House of Representatives had previously passed a version of the legislation last month.

With respect to marijuana tax revenue, Illinois is using part of those dollars to fund equity initiatives in the state. For example, officials announced in December that applications were opening for $45 million in new grants—funded by cannabis tax money—that will support programs meant to reinvest in communities most harmed by the drug war.

This is the second round of funding to be issued through the state’s Restore, Reinvest, and Renew (R3) program, which was established under Illinois’s adult-use cannabis legalization policy. The law requires 25 percent of marijuana tax dollars to be put in that fund and used to provide disadvantaged people with services such as legal aid, youth development, community reentry and financial support.

Organizations that received grants through the initial R3 round will have their funding renewed for another year to ensure that they can continue providing services in their communities.

Last year, in July, state officials put $3.5 million in cannabis-generated funds toward efforts to reduce violence through street intervention programs.

In addition to providing such funding, Gov. J.B. Pritzker (D) announced in 2020 that his office had processed more than 500,000 expungements and pardons for people with low-level cannabis convictions on their records.

A state-funded initiative was also recently established to help residents with marijuana convictions get legal aid and other services to have their records expunged.

It’s these types of initiatives that Toi Hutchinson recently told Marijuana Moment that she’s most proud of as she transitioned from being Pritzker’s cannabis advisor to the president of the national advocacy group, the Marijuana Policy Project (MPP).

Outside of Illinois, officials in nearby Michigan officials announced late last month that they will be distributing nearly $150 million in marijuana tax revenue, divided between localities, public schools and a transportation fund. And separately, regulators have approved the state’s first licensed cannabis consumption lounge, which is set to open this month.

Massachusetts is collecting more tax revenue from marijuana than alcohol, state data released in January shows. As of December 2021, the state took in $51.3 million from alcohol taxes and $74.2 million from cannabis at the halfway point of the fiscal year.

States that have legalized marijuana have collectively garnered more than $10 billion in cannabis tax revenue since the first licensed sales started in 2014, according to a report released by MPP in January.

California officials announced in June that they were awarding about $29 million in grants funded by marijuana tax revenue to 58 nonprofit organizations, with the intent of righting the wrongs of the war on drugs. The state collected about $817 million in adult-use marijuana tax revenue during the 2020-2021 fiscal year, state officials estimated last summer. That’s 55 percent more cannabis earnings for state coffers than was generated in the prior fiscal year.

In Colorado, nearly $500 million of cannabis tax revenue has supported the state’s public school system. That state brought in a record $423 million in marijuana tax dollars last year.

Maryland Lawmakers Discuss Senate-Passed Bill To Fund Psychedelics Research And Access For Veterans

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.