The number of banks and credit unions reporting that they work with marijuana businesses ticked up last quarter, according to new federal data.

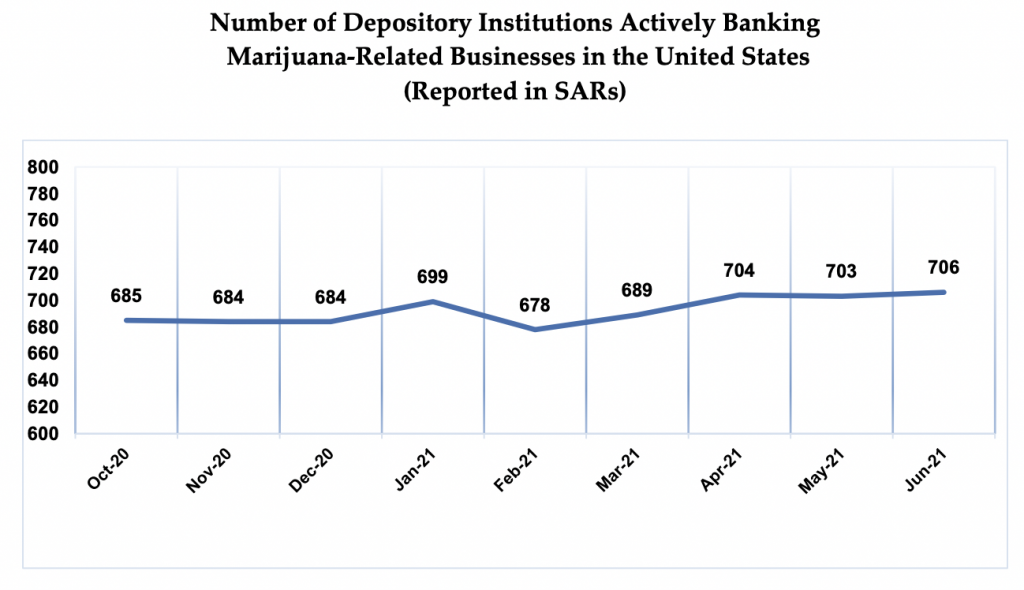

As of June 30, there were 706 financial institutions that had filed requisite reports saying they were actively serving cannabis clients. Thats up from 689 in the previous quarter but still down from a peak of 747 in late 2019.

Via FinCEN.

The new figures released by the Financial Crimes Enforcement Network (FinCEN) come amid a congressional push to protect banks and credit unions that work with the cannabis industry from being penalized by federal regulators.

While there’s 2014 FinCEN guidance in place meant to help financial institutions navigate the space, lawmakers want to enact clear, statutory protections. And that would be accomplished through House-passed standalone legislation, or an amendment that was attached to a defense spending bill this week.

Until then, there’s still reluctance within the banking sector when it comes to servicing businesses that work with a Schedule I controlled substance, and that’s reflected in the relatively low number of depository institutions that actually follow the guidance and take on cannabis clients.

Last year saw a significant and consistent drop in the number of banks and credit unions that reported having marijuana accounts, but those figures began to stabilize this year.

“Short-term declines in the number of depository institutions actively providing banking services to marijuana-related businesses (MRBs) may be explained by filers exceeding the 90 day follow-on Suspicious Activity Report (SAR) filing timeframe,” FinCEN, which is part of the Treasury Department, said. “Several filers take 180 days or more to file a continuing activity report. After 90 days, a depository institution is no longer counted as providing banking services until a new guidance-related SAR is received.”

Past reports from the agency had noted that it stopped including hemp-only businesses in its quarterly reports since the crop was federally legalized under the 2018 Farm Bill, which could account for at least some of the drop depicted in earlier data, but that language does not appear in this latest report.

Also, FinCEN didn’t mention the potential impact of the coronavirus pandemic on marijuana banking trends this time.

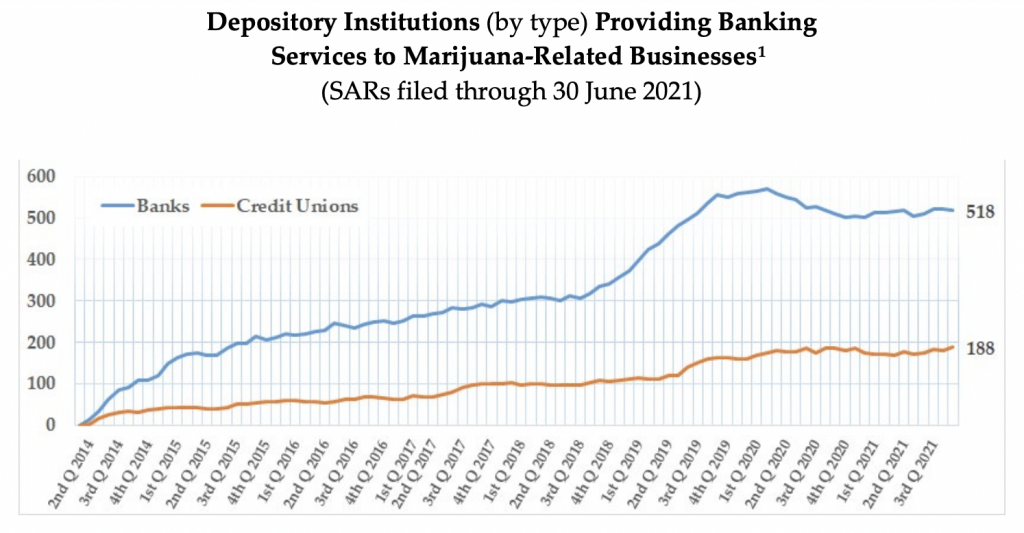

As of the end of last quarter, there were 518 banks and 188 credit unions reporting active marijuana clients, according to the federal agency.

Via FinCEN.

When it comes to the prospects of enacting cannabis banking reform, stakeholders are encouraged by the inclusion of the Secure and Fair Enforcement (SAFE) Banking Act in the must-pass National Defense Authorization Act (NDAA) and hope that will be the vehicle to finally provide safeguards to the financial sector.

But while the issue is bipartisan, the proposal will face challenges in the Senate, where key leaders have insisted that comprehensive legalization should advance first before lawmakers enact a policy change that’s viewed as principally favorable to the industry.

Sen. Cory Booker (D-NJ), for example, has said that he “will lay myself down” to block any other senators who seek to pass marijuana banking legislation before the body approves comprehensive cannabis reform like the federal legalization bill he unveiled alongside Senate Majority Leader Chuck Schumer (D-NY) and Senate Finance Committee Chairman Ron Wyden (D-OR).

—

Marijuana Moment is already tracking more than 1,200 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

Rep. Ed Perlmutter (D-CO), chief sponsor of the SAFE Banking Act, spoke with Marijuana Moment about the process moving forward in a phone interview on Wednesday. He said he is optimistic about the measure’s prospects with NDAA as the vehicle, though he conceded that he hadn’t spoken with Schumer or other key senators who are actively finalizing the legalization legislation.

“I think the fifth time is the charm,” he said. “I mean, obviously, we still have to do some work to make sure that it remains part of the NDAA as the House and the Senate go to conference. So we still have work to do with the Senate to make sure that it remains part of it. But I think that it will.”

“I mean, the fact that it deals with cartels and national security, on top of the need for the public safety piece of this thing, I think that we’ll be able to convince the conference committee and the conferees generally to keep it in,” he said. “But we still have work to do.”

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.