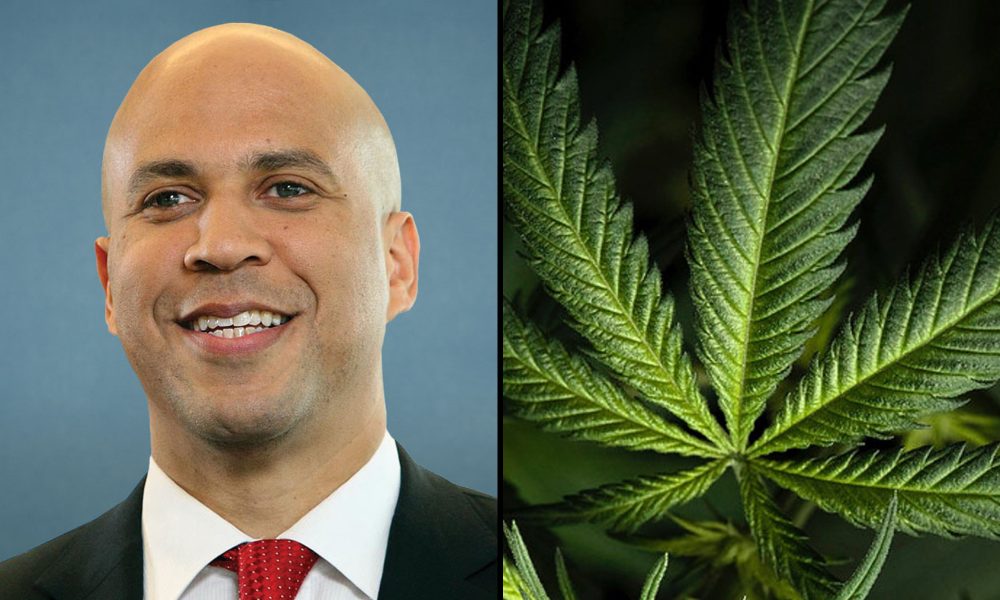

Sen. Cory Booker (D-NJ) says that a standalone marijuana banking reform bill “requires changes” if it’s going to advance before cannabis is federally legalized.

The senator, who is one of the three prime sponsors of a recently filed measure to comprehensively end prohibition, didn’t get into the specifics of what revisions he wants to see made to the Secure and Fair Enforcement (SAFE) Banking Act—but he said in a statement on Wednesday that industry equity for communities harmed by the drug war must be a priority.

While Booker has made several recent comments about his openness to moving more incremental cannabis legislation, including protections for banks that work with state-legal marijuana businesses despite previously saying he would block the financial reform, his latest remarks come amid a push by current and former cannabis regulators to make a series of equity-centric amendments to the standalone bill.

“For decades, largely Black and Brown communities have been disproportionately harmed by the prohibition of marijuana and are subsequently underrepresented in the emerging billion-dollar cannabis industry,” he said in a press release that coincided with an event hosted by Cannabis Regulators of Color Coalition (CRCC), which released a paper this week on the need for SAFE Banking revisions.

“We all agree that the path to ensuring true equity within the marijuana industry starts with decriminalizing cannabis at the federal level,” Booker said. “Before moving forward, legislation like SAFE Banking requires changes to ensure that the communities most harmed by our broken marijuana policies receive support and small cannabis businesses can have the same access to capital as large multi-state operators.”

The senator didn’t explicitly endorse any of CRCC’s proposed amendments in the comment he provided for the group’s event, but the regulators’ recommendations for SAFE Banking, which has passed the House in some form seven times now, are designed to achieve that fundamental goal of enhanced equity within the marijuana market.

In its paper, CRCC called for 10 amendments, including ones to require financial institutions to prove compliance with anti-discrimination laws in order to receive the marijuana-specific protections offered under SAFE, require financial regulators to develop best practices to “achieve racial equity” in their services and expand federal study and reporting requirements to more holistically cover financial barriers faced by women-, minority- and equity-owned cannabis businesses.

“Without additional legislative amendments to directly address challenges related to fair and equitable access to financial services, small and minority-owned cannabis businesses that currently have inadequate access to banking services or loans are likely to continue to be denied the full breadth and depth of services offered to others,” the paper says.

Booker, as well as key lawmakers like Senate Majority Leader Chuck Schumer (D-NY), have been especially vocal about the need for comprehensive marijuana reform—and they’ve long been critical about the idea of advancing the standalone SAFE Banking Act as an interim step toward that broader goal.

But since filing the Cannabis Administration and Opportunity Act (CAOA) last month, the senators have softened their stance, expressing their willingness to reach a compromise on a passable package of marijuana reforms that’s been described as “SAFE Banking Plus.”

—

Marijuana Moment is tracking more than 1,500 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

The details of that in-progress cannabis omnibus bill aren’t known yet, but it’s expected to contain equity components like bipartisan marijuana expungements proposals—and it’s conceivable that lawmakers could also push to incorporate SAFE Banking amendments as outlined by the new CRCC paper.

Shaleen Title, a co-founder of CRCC and former Massachusetts cannabis regulator, said during Wednesday’s virtual event that the reason she’s optimistic about SAFE Banking “for the first time” is because “legislators and their staff and the public seem to have shifted on this versus, say, six months ago” when equity considerations weren’t receiving serious attention in the context of the bill.

“What we’re seeing is an interest in multiple avenues” to enact the types of reforms outlined in the group’s paper, she said. “I hope this paper and these recommendations are a good starting point.”

Schumer has been holding high-level talks with bipartisan and bicameral offices as lawmakers work to put a cannabis reform package together. And while the timeline isn’t clear, Booker said he expects to see movement on the yet-to-be-released proposal during the lame duck period between November’s elections and the start of a new Congress in January.

Booker initially signaled that he was coming around to marijuana banking reform (contingent on equity provisions) at a Senate Judiciary subcommittee hearing last month that he convened as chairman.

Meanwhile, the bicameral sponsors of the SAFE Banking Act, Reps. Ed Perlmutter (D-CO) and Sen. Jeff Merkley (D-OR), laid out next steps for the cannabis banking reform last month at a briefing organized by the U.S. Cannabis Council (USCC).

Also at that briefing, Rep. Earl Blumenauer (D-OR) said that he recently spoke with Booker about the pathway for marijuana reform this session, and they had a “great conversation” about finding areas of compromise.

“I think the senator is fully aware of the consequences of this failed policy of prohibition in terms of what it does with the SAFE Banking Act and the threat that is made to the very communities he wants to support,” the congressman said in response to a question from Marijuana Moment. “I think he’s trying to be able to thread the needle.”

Perlmutter also said in a recent interview that he feels the introduction of CAOA alone in the Senate means that lawmakers have overcome a legislative “hurdle” that’s kept SAFE Banking from advancing in the chamber.

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.