Minnesota’s warm embrace of hemp-derived THC products set itself apart from other states with legal, regulated adult-use marijuana access.

But sudden changes imposed last month to how hemp products are tested, transported and labeled are encouraging some hemp companies to pull up stakes and relocate to other states, operators told MJBizDaily.

Hemp THC products, including drinks and edibles, have been legal in Minnesota since July 2022.

Sales of consumable hemp products in Minnesota reached $145.1 million from October 2023 through September 2024, according to Denver-based cannabis law firm Vicente.

But starting Jan. 1, all intoxicating hemp products sold in Minnesota must also be tested in Minnesota, which has just two operating testing labs, according to state records.

That’s according to an Oct. 10 “guidance memo” released to little fanfare by the state Office of Cannabis Management.

Testing, packaging and labeling requirements have been in place since the cannabis bill was passed in 2023, and rules governing how the statutes are implemented were adopted through a public review process with an administrative law judge in April 2025, said OCM Communications Director Josh Collins.

The OCM put out guidance in July on a product transition period to provide flexibility around product lableing and testing to help hemp businesses clear out products that had been tested/labeled under the sunsetting legislation. It issued further guidance last month, Collins said.

And it’s not just testing requirements that are threatening to reshape the state’s hemp industry.

There’s also:

- A new ban on shipping low-potency hemp THC products via the mail.

- New labeling requirements mandating supply chain information, which some operators claim are “trade secrets,” be printed on products.

Operators and lab officials alike say the changes, following the launch of non-tribal adult-use marijuana sales in September, threaten to reshape the state’s hemp market just as major players like Target, headquartered in the state, jump into the sector.

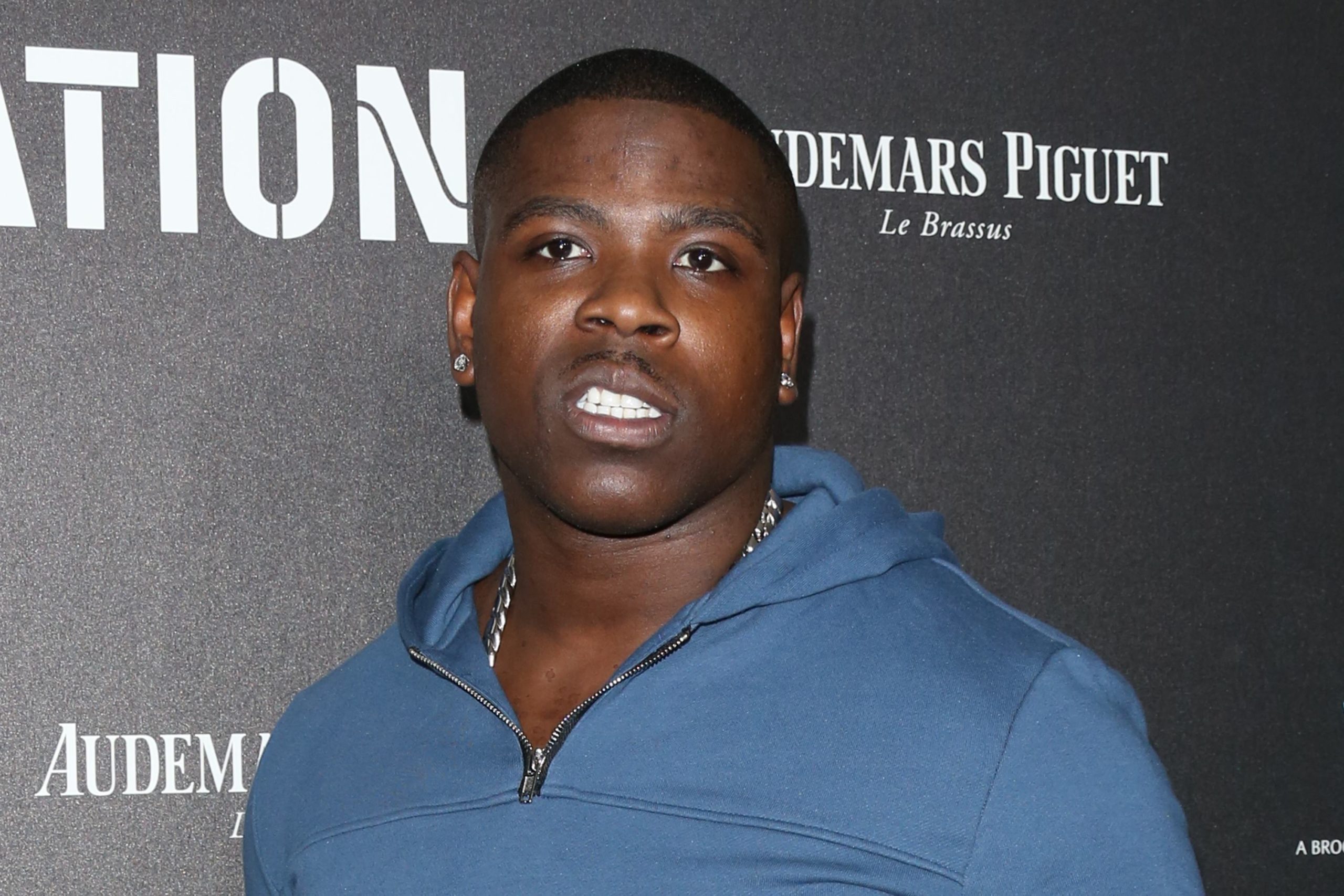

“This just feels like the OCM is trying to kill hemp,” said Lance Asher, founder of Green Elevator Cannabis, which makes intoxicating hemp gummies and beverages.

Minnesota hemp THC operators seeking greener pastures

The new rules are enough to compel edibles and beverage maker Steven Brown to spend up to $100,000 to move his Nothing But Hemp business to Wisconsin, where hemp cafes and taverns serving hemp drinks are thriving.

Currently, Nothing But Hemp uses testing labs in Wisconsin, Kentucky and Florida.

Brown, the founder and CEO, decides which one he’ll use based on how quickly they can provide the results.

“We have contract obligations (with wholesale clients) to keep the input going, and I can’t do that in Minnesota,” he said.

The two state licensed labs’ limited capacity could also result in a backlog of products stuck waiting for testing before they can be sold, Brown said.

A third lab is expected to come online within the next month.

Republican state Rep. Nolan West said that because hemp is federally legal, requiring hemp products to be tested in Minnesota is unnecessary.

“My goal is to not require hemp products to be tested in the state – there’s no reason because it’s federally legal and can be transported,” West said.

“At minimum, I would like to delay in-state testing for another two to 50 years.”

New hemp testing rules creates lab strain

The new testing requirements also took labs by surprise.

St. Paul-based licensed testing lab Legend Technical Services Inc., had been gearing up for the state’s adult-use market but was not anticipating adding hemp products to the mix, according to project manager Taylor Schertler.

“Scaling doesn’t happen quickly,” he said. “It takes time to get new people up to speed and incorporate new equipment into the workflow.”

Schertler said he expects testing turnaround times to increase from about two weeks to as long as four weeks.

However, he doesn’t anticipate raising prices, which range from $300 to test a finished product to $850 for a batch of raw plant material.

While the testing requirement will result in supply chain delays, “it’s not because of us or any of the other labs dropping the ball,” Schertler said.

“It’s because of this last-minute decision on hemp products have to be tested in state.

“We’ve been thrown off the deep end with weights around our ankles.”

Brad Larmie, chief growth officer of ChRi Laboratories, said the company was prepared for testing adult-use products but said he can’t predict how adding THC beverage makers and other manufacturers of intoxicating hemp products will impact the workflow.

“Backlog is a hard question to answer,” Larmie said. “People are still getting their adult-use licenses. Some are manufacturers, but you don’t know how many people they support.

“The hardest thing to quantify is how big of a backlog we should expect.”

Labeling mandates reveals hemp THC trade secrets

“Hilariously bad” labeling requirements are another pain point, according to West.

Labels must disclose detailed supply chain information, including the names and license numbers of cultivator, processors and manufacturers.

While the state’s Office of Cannabis Management should have access to the information, it shouldn’t be required to be printed on the label, he argued.

“The new label requirements expose much of the supply chain, effectively revealing trade secrets,” Brown said.

West suggested that the department make ingredients sourcing accessible to consumers through a data request.

“It’s important that the label is detailed, but there’s no reason it couldn’t be on a QR code,” West said.

Green Elevator’s Asher said he’d invested in boxes and bags for gummies that he expected would last for a certain period of time.

With the new regulations, he’s going to have to print stickers to bring that packaging into compliance when the new rules take effect.

“You’ve got rolls of previous labels you’ve already bought in bulk so you can get good pricing,” Asher said.

“I can get it done in a few weeks, but that’s a lot of time I need to invest in stickering a bunch of packaging that was compliant but now is not.”

No more shipping low-THC hemp products via the mails

Another issue for Asher is distribution to the 150 stores in a handful of states that carry his products.

He must now find a distributor because the new regulations prohibit direct-to-consumer shipments of low-potency THC edibles, a measure hemp businesses are pushing back on.

If he wants to continue transporting his own products, Asher said he would be required to get a wholesaler license and would only be permitted to sell only his own products.

Registration would cost $250, and he’d have to pay a $10,000 license fee, he said.

“I’m a sole owner and don’t desire to have any other investors or partners,” Asher said.

“We’re being forced away from what it is we’ve been doing with good regulations that make sense. If we look at what the law is and what rules are being made, it really feels like they haven’t really listened.”

Margaret Jackson can be reached at margaret.jackson@mjbizdaily.com.

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.