(This is a contributed guest column. To be considered as an MJBizDaily guest columnist, please submit your request here.)

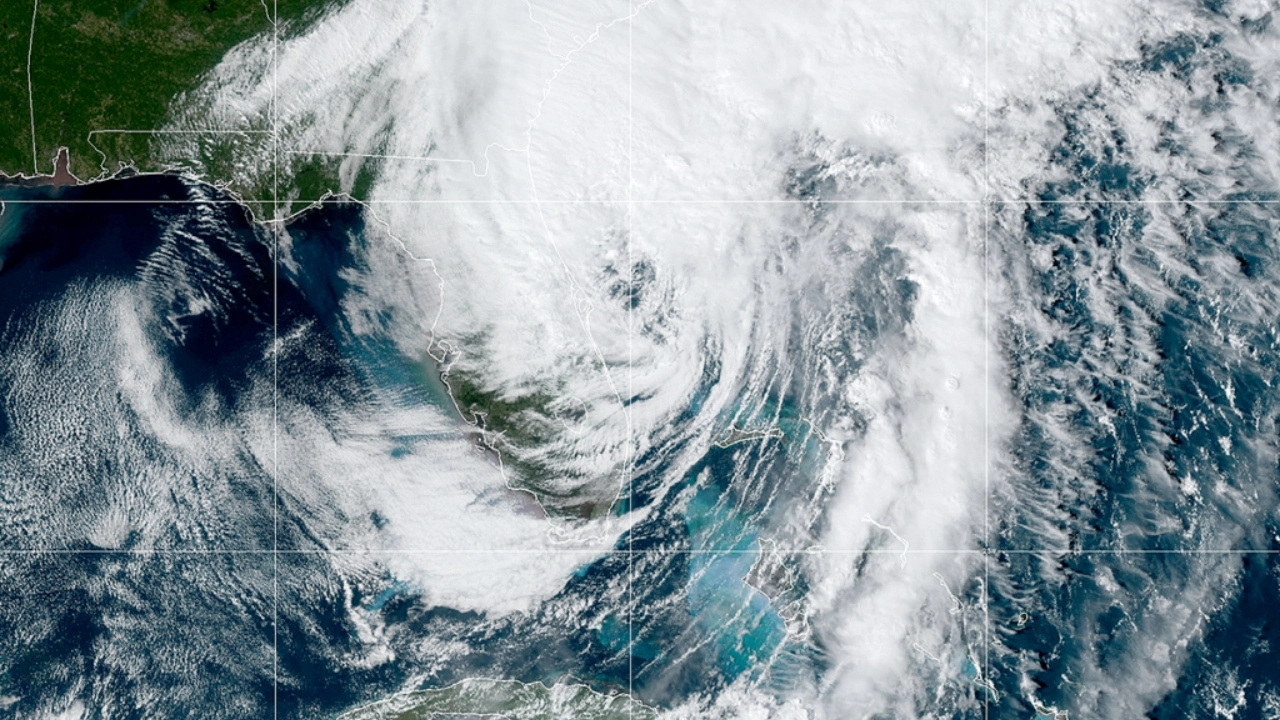

Many business owners are thinking about climate change as they reflect on a historic 2024 hurricane season and anticipate what a second Trump administration might mean for environmental and business regulation.

It’s an especially acute subject for cannabis license holders – particularly those who operate plant-touching businesses such as cultivation facilities and medical marijuana dispensaries or adult-use stores.

Insurance is mandatory for a cannabis business, but all too often it still slips through the cracks – especially when insurance policies are as difficult to obtain as investment funding, payroll services and other financial products standard in other industries.

As I’ve seen time and time again working with Colorado cannabis business owners, filing a claim is a terrible time to realize your insurance coverage is lacking.

Of course, the potential for climate-related insurance claim scenarios is higher every year.

Recent disasters in cannabis markets

After wildfires leveled entire neighborhoods in Southern California in January and Hurricane Helene devastated southern Appalachia in the fall of 2024, it’s increasingly clear that there is no such thing as a climate refuge.

Smoke from wildfires, water damage from flash floods and storm surges and damage or loss from heat waves or unexpected freezes are some of the extreme weather events that already are impacting businesses nationwide.

In the past five years, there have been several notable natural disasters that have hit cannabis businesses hard from the West Coast to southern Florida.

In 2019, for example, Colorado-based Los Sueños Farms lost 20,000 cannabis plants to an unseasonably early October snowstorm.

A study from the University of California Berkeley’s Cannabis Research Center found that wildfire and smoke exposure between 2020 and 2021 caused $2.4 billion in damages and at least 25% production loss to cannabis cultivators.

And the 2022 landfall of Hurricane Ian closed hundreds of Florida cannabis businesses, damaged property and tanked cannabis stocks.

Meanwhile, even parts of the country with less-dramatic weather events are experiencing shifts in average temperature and humidity that could impact major aspects of commercial cannabis cultivation, such as outdoor versus indoor operations or cannabis genetics selection.

Insuring against disaster

Anticipating future climate impacts – whether a decade down the road or next hurricane season – adds layers of complexity to the already challenging aspect of running a cannabis business.

State licensing requirements and other regulations frequently stipulate that businesses carry a wide range of insurance coverages, from business owners’ policies and commercial general liability to workers’ compensation.

Under federal marijuana prohibition, however, brokers and insurers aren’t always willing to issue policies.

Cannabis businesses – especially those in emerging markets – often are caught between licensing and leasing requirements and the availability of “admitted market” insurance products, aka standardized policies such as homeowners insurance, travel insurance or accidental death insurance.

In the absence of available admitted market policies, cannabis businesses frequently rely on “surplus line” insurance products designed to fill gaps or cover unusual liabilities.

Like anything bespoke, surplus line policies take additional time, money and consideration to arrange.

Some states such as Vermont require cannabis business owners to self-insure through funds in escrow for specific liability thresholds if they cannot obtain commercially reasonable levels of insurance.

Other types of insurance are simply growing more costly for businesses in all sectors, not just cannabis.

For instance, crop insurance already is getting more expensive across the agricultural industry, thanks to intensifying climate events.

But there’s simply less data available on commercial cannabis crops thanks to decades of federal prohibition—and insurance companies like to have robust data to inform their underwriting decisions.

2024 MJBiz Factbook – now available!

Exclusive industry data and analysis to help you make informed business decisions and avoid costly missteps. All the facts, none of the hype.

Featured inside:

- Financial forecasts + capital investment trends

- 200+ pages and 49 charts highlighting key data figures and sales trends

- State-by-state guide to regulations, taxes & market opportunities

- Monthly and quarterly updates, with new data & insights

- And more!

Cannabis insurance changes ahead?

There has been some positive progress, such as the USDA’s 2021 decision to improve crop insurance for hemp producers.

The move gave more options for insurance to cultivators in the federally legal hemp industry that has developed parallel to state markets for regulated medical and adult-use cannabis—and importantly, it also established a model for potential future policies applicable to high-THC cannabis.

Under the current paradigm, insurance can be especially burdensome with the narrow margins on which many cannabis businesses operate, not to mention the significant tax burden.

But as more states move to legalize—as Nebraska did during the 2024 election cycle—more cannabis companies are exposed to climate risks.

Owners and operators must read licensing requirements, leases and insurance policies very closely.

Already, a growing body of legal precedents have established that the difference between a payout and a claim denial can hinge on specific details and wording that can be easy to overlook.

Not only can that put the business at risk but it can also open up licensees to personal liability for professional exposures.

Here are three key insurance questions to ask when you are establishing a policy:

- Can you walk me through the exclusions section?

- What documentation is required for claims?

- If I need to appeal a denied claim, what does that process look like?

Ultimately, insurance is designed to protect cannabis companies from growing threats related to climate change and natural disasters, as well as the usual day-to-day liabilities that come with doing business.

Overlooking this area of operations and governance is a mistake that could prove very costly—even more so than the policies themselves.

Alyson Jaen is an attorney specializing in cannabis law, licensing and regulatory compliance as well as general corporate and business law at Denver-based Messner Reeves law firm. She can be reached at ajaen@messner.com.

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.