States that have legalized marijuana for adult use collectively generated more than $3.7 billion in tax revenue from recreational cannabis sales in 2021, a report from the Marijuana Policy Project (MPP) that was released on Wednesday found.

That’s a 34 percent increase compared to revenue that states received from cannabis sales in 2020.

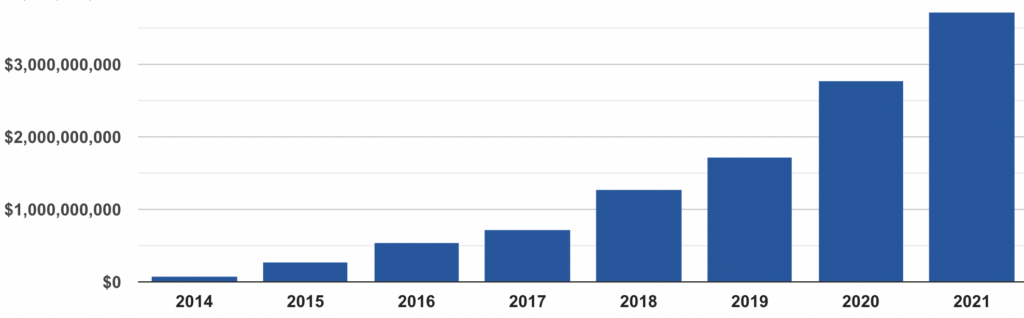

The report follows up on an analysis MPP put out in January that looked at the total adult-use cannabis tax revenue collected by all legal states since recreational sales started in Colorado and Washington State in 2014. At the time, the 2021 figures were incomplete but still showed that states received more than $10 billion in tax dollars from recreational marijuana sales over the past seven years.

Now that the data is updated for 2021, the organization says the 2014-2022 total as of March is $11.2 billion.

Via MPP.

Toi Hutchinson, president and CEO of MPP, said that the report provides “further evidence that ending cannabis prohibition offers tremendous financial benefits for state governments.”

“The legalization and regulation of cannabis for adults has generated billions of dollars in tax revenue, funded important services and programs at the state level and created thousands of jobs across the country,” she said in a press release. “Meanwhile, the states that lag behind continue to waste government resources on enforcing archaic cannabis laws that harm far too many Americans.”

MPP’s total does not include medical cannabis tax revenue, application and licensing fees paid by marijuana businesses, income taxes generated by cannabis industry workers or corporate taxes paid to the federal government—meaning that legalization’s overall impact on government coffers is even larger than the billions in recreational sales tax revenue that’s reported.

Here’s a breakdown of the 2021 recreational marijuana tax revenue for each adult-use state:

• Alaska: $28,900,231

• Arizona: $153,824,757

• California: $1,294,632,799

• Colorado: $396,157,005

• Illinois: $424,206,703

• Maine: $12,362,622

• Massachusetts: $227,474,842

• Michigan: $209,912,278

• Nevada: $159,885,501

• Oregon: $177,773,944

• Washington: $630,863,570

And here are the year-by-year figures for all adult-use state cannabis sales tax revenue combined:

• 2014: $68,503,980

• 2015: $264,211,871

• 2016: $530,521,110

• 2017: $723,145,481

• 2018: $1,275,483,830

• 2019: $1,707,204,090

• 2020: $2,766,027,570

• 2021: $3,715,994,252

Legalizing cannabis for adults has been a wise investment. In 2021 alone, legalization states generated more than $3.7 billion in cannabis tax revenue from adult-use sales. https://t.co/PIBn6kwVtg

— Marijuana Policy Project (@MarijuanaPolicy) April 6, 2022

The report also describes different ways that states are distributing cannabis revenue for various programs and initiatives, including community reinvestments that are meant to support those most impacted by criminalization.

In a more recent allocation, Michigan officials announced last month that they will be distributing nearly $150 million in marijuana tax revenue, divided between localities, public schools and a transportation fund.

Massachusetts is collecting more tax revenue from marijuana than alcohol, state data released in January shows. As of December 2021, the state took in $51.3 million from alcohol taxes and $74.2 million from cannabis at the halfway point of the fiscal year.

Illinois also saw cannabis taxes beat out booze for the first time last year, with the state collecting about $100 million more from adult-use marijuana than alcohol during 2021. And new data shows that Illinois’s adult-use market saw its second highest month of cannabis sales in March, reaching $131 million.

That state is dedicating portions of tax revenue to mental health services, as well as local organizations “developing programs that benefit disadvantaged communities.” In July, state officials put $3.5 million in cannabis-generated funds toward efforts to reduce violence through street intervention programs.

California officials announced in June that they were awarding about $29 million in grants funded by marijuana tax revenue to 58 nonprofit organizations, with the intent of righting the wrongs of the war on drugs. The state collected about $817 million in adult-use marijuana tax revenue during the 2020-2021 fiscal year, state officials estimated last summer. That’s 55 percent more cannabis earnings for state coffers than was generated in the prior fiscal year.

In Colorado, nearly $500 million of cannabis tax revenue has supported the state’s public school system. That state brought in a record $423 million in marijuana tax dollars last year.

Delaware Marijuana Legalization Effort Revived With Two-Track Approach Following House Defeat

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.