It’s not just marijuana businesses that stand to benefit from a bipartisan cannabis banking bill, a senator and top insurance official said on Thursday. It’s also about safeguards for ancillary companies that serve the industry—like a lightbulb manufacturer whose product malfunctions in a grow house, catching fire and creating insurance liabilities.

Sen. Bob Menendez (D-NJ) gave the lightbulb example during a Senate Banking Committee hearing, where he talked about the need to pass the Secure and Fair Enforcement (SAFE) Banking Act, which also contains insurance-related provisions that were integrated from separate legislation he’s sponsoring.

According to congress.gov, this technically marks the first Senate hearing on the SAFE Banking Act during the 117th Congress, even if the legislation was only briefly discussed as part of a broader meeting on insurance issues.

“I’m concerned that businesses that have nothing to do with cannabis could face serious consequences” under the current law, Menendez said, addressing Kathleen Birrane, a representative of the National Association of Insurance Commissioners (NAIC).

“Imagine a scenario where a New Jersey lightbulb manufacturer sells a product to a state-legalized cannabis business and there’s a fire related to the lightbulb causing the business to suffer loss,” he said. “Under current law in the scenario I just described, could the lightbulb manufacturer’s insurance company face federal charges they paid the claim?”

Birrane replied that NAIC supports the “really critical” cannabis banking reform, telling Menendez that “the challenges that insurance companies have is using the banking system to transfer funds to a cannabis business.”

“So the answer is that that is a circumstance which could be challenging for that lightbulb company’s insurer in trying to use the banking system to pay money to the cannabis business,” Birrane, who serves as Maryland’s insurance commissioner, said.

“It’s really critical that businesses be able to buy insurance, that they be able to pay for that insurance and, when claims occur, that insurance companies be able to use the banking system to pay those claims,” she said. “The SAFE Banking Act would allow that to happen.”

While there are some lawmakers who would like to see the standalone bill brought to the floor for a vote, with the expectation that it enjoys enough bipartisan support to be enacted, leadership isn’t on board with the legislation as drafted.

Senate Majority Leader Chuck Schumer (D-NY) filed a comprehensive legalization bill in July, alongside Senate Finance Committee Chairman Ron Wyden (D-OR) and Sen. Cory Booker (D-NJ). But the political challenges of reaching the 60-vote threshold to pass that measure in the Senate has prompted talks about a scaled back compromise.

—

Marijuana Moment is tracking more than 1,500 cannabis, psychedelics and drug policy bills in state legislatures and Congress this year. Patreon supporters pledging at least $25/month get access to our interactive maps, charts and hearing calendar so they don’t miss any developments.![]()

Learn more about our marijuana bill tracker and become a supporter on Patreon to get access.

—

Specifically, Schumer is actively talking with offices in both parties and both chambers about putting together an alternative package of marijuana reform proposals, colloquially known as “SAFE Banking Plus.”

That cannabis omnibus legislation has yet to be filed, but the sponsor of the standalone SAFE Banking Act gave some details about what’s being considered during a conference on Thursday. Beside the banking protections, he said there are talks about incorporating expungements for people in legal states and community reinvestment funding.

“It’s time to close the deal in SAFE Banking Plus,” Sen. Jeff Merkley (D-OR) said. “No one has paid a political price ever for supporting cannabis in this country.”

According to a poll from Independent Community Bankers of America (ICBA) that was released this week, a majority of American voters (65 percent) support allowing banks to work with state-legal marijuana businesses—and most people believe it will both improve public safety and promote social equity.

The survey results are consistent with the findings of a separate poll from the American Bankers Association (ABA) that was released in March. It also showed that 65 percent of Americans back the marijuana banking reform.

Separately, the non-partisan National Conference of State Legislatures (NCSL) recently voted to adopt a revised policy directive that expresses support for federal marijuana descheduling and cannabis banking reform amid the state-level legalization movement.

Cannabis Regulators of Color Coalition (CRCC) released a paper last month that outlined what they view as shortcomings of the standalone SAFE Banking Act and recommended several amendments to bolster its equity impact.

Booker said at an event organized by CRCC last month that the standalone legislation “requires changes” if it’s going to advance before cannabis is federally legalized.

The senator initially signaled that he was coming around to marijuana banking reform (contingent on equity provisions) at a Senate Judiciary subcommittee hearing in July that he convened as chairman.

Meanwhile, the bicameral sponsors of the SAFE Banking Act, Reps. Ed Perlmutter (D-CO) and Merkley, laid out next steps for the cannabis banking reform at a briefing organized by the U.S. Cannabis Council (USCC) in July.

Also at that briefing, Rep. Earl Blumenauer (D-OR) said that he recently spoke with Booker about the pathway for marijuana reform this session, and they had a “great conversation” about finding areas of compromise.

“I think the senator is fully aware of the consequences of this failed policy of prohibition in terms of what it does with the SAFE Banking Act and the threat that is made to the very communities he wants to support,” the congressman said in response to a question from Marijuana Moment. “I think he’s trying to be able to thread the needle.”

Perlmutter also said in a recent interview that he feels the introduction of the Senate legalization bill alone means that lawmakers have overcome a legislative “hurdle” that’s kept SAFE Banking from advancing in the chamber.

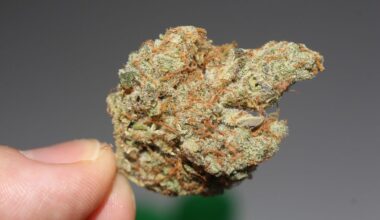

Photo courtesy of Chris Wallis // Side Pocket Images.

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.