(This is a contributed guest column. To be considered as an MJBizDaily guest columnist, please submit your request here.)

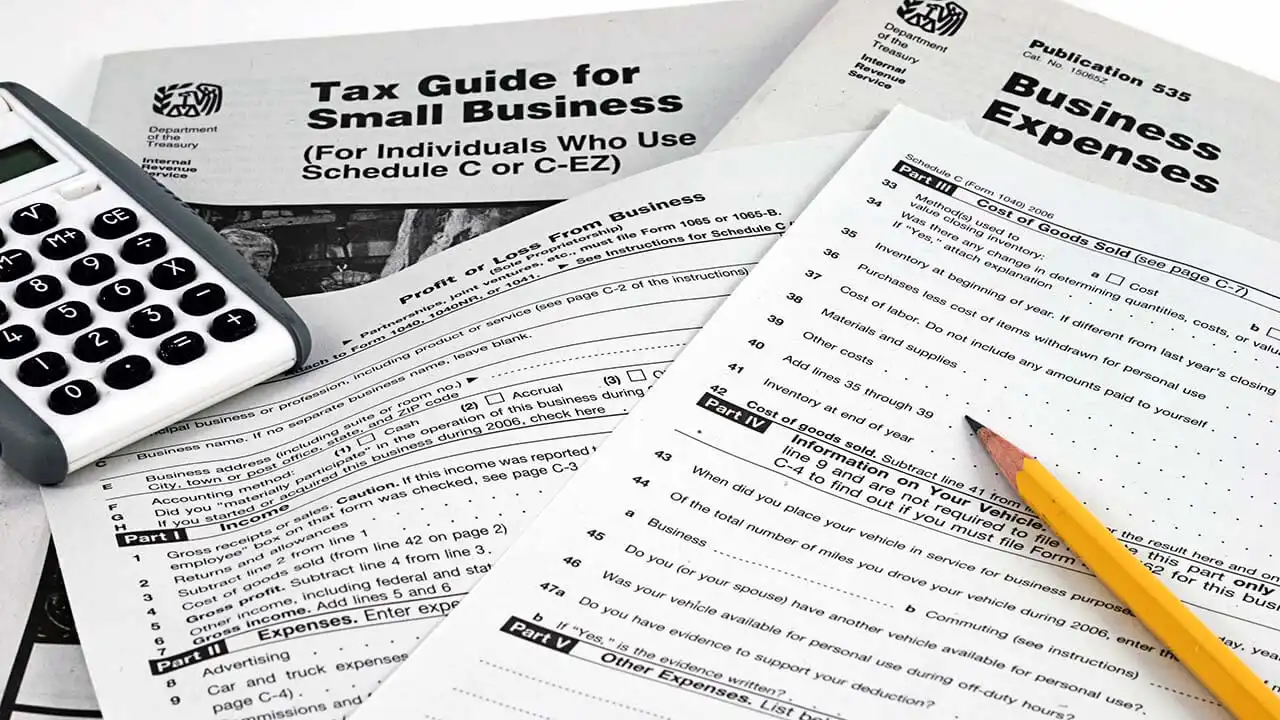

Since the first legal marijuana business stepped out of the shadows, Internal Revenue Code Section 280E has quietly drained the industry, turning modest profits into massive tax liabilities and legal businesses into tax pariahs.

Originally passed in 1982 to penalize cocaine traffickers, 280E applies to fully licensed, tax-paying cannabis companies in compliance with state law. What began as a targeted tool has evolved into financial punishment and a contradiction of the very structure of legal markets.

And in 2025, the weight of that contradiction is becoming too large to ignore.

For the past eight years, I’ve worked in cannabis accounting and seen firsthand how burdensome and inequitable Section 280E can be.

The conclusion is unavoidable: this provision isn’t just bad policy. It may be unconstitutional. And it is already destabilizing the financial future of an entire sector.

280E creates ‘phantom income’ for marijuana companies

While the 280E tax code was written to prevent illegal drug traffickers from deducting business expenses, its continued application to state-licensed cannabis operators is rooted in outdated scheduling laws, not modern realities.

Under federal law, 280E applies to “any trade or business” involving a Schedule 1 or Schedule 2 drug under the Controlled Substances Act.

The cannabis industry today operates under strict state oversight. Businesses comply with track-and-trace requirements, banking regulations, labor laws, and extensive licensing.

Yet the federal tax code still treats these same businesses as if they are cocaine cowboys, denying them deductions for basic business expenses like rent, payroll, and security.

This results in what we call “phantom income,” or taxes owed on income never actually received.

That’s not just a financial inconvenience. In some cases, it’s an existential threat.

280E’s six Constitutional violations

A deeper legal review reveals six specific constitutional arguments that challenge the application of 280E to legal cannabis businesses.

These include:

- Fifth Amendment due process violations, as 280E establishes arbitrary classifications lacking a rational basis while violating equal protection principles.

- Eighth Amendment violations for excessive Fines, as 280E functions as a grossly disproportionate punishment, with effective tax rates of more than 70%.

- Tenth Amendment violations of concepts of federalism, as it undermines state sovereignty by characterizing state-regulated commerce as federal criminal “trafficking.”

These aren’t theoretical.

Several cases are now progressing through federal courts. And each one is pushing us closer to a reckoning on whether 280E can continue to coexist with the state-regulated cannabis economy.

From quiet compliance to legal resistance

Until recently, most cannabis operators saw 280E as an unfortunate cost of doing business.

That changed in 2023 and 2024 when several major marijuana multi-state operators filed amended tax returns challenging 280E and seeking hundreds of millions in refunds.

These MSOs included Trulieve Cannabis, Curaleaf Holdings, Ascend Wellness, and Cresco Labs.

They weren’t just filing returns. They were building tax strategies.

Many are now basing their claims on intrastate commerce arguments, asserting that the federal government has no constitutional authority to tax state-only cannabis activity under the Commerce Clause.

The development marks a major shift: from passive compliance to coordinated legal resistance.

These moves aren’t limited to the courtroom. They’re also reshaping how cannabis companies approach risk, tax planning, and compliance, setting new expectations for professional services and investor relations.

What cannabis businesses can do now

While not every operator can afford to take the Internal Revenue Service to court, every business can build a smarter 280E strategy.

Key actions include:

- Filing protective refund claims before the statute of limitations closes;

- Segmenting operations to clarify intrastate vs. interstate activity;

- Documenting risk tolerance with boards, investors, and finance teams;

- Engaging professionals trained in both cannabis compliance and constitutional tax issues.

Crucially, these strategies are not about “avoiding” 280E. They are about mitigating exposure within legal bounds, protecting cash flow, and staying audit-ready in a shifting regulatory environment.

Subscribe to the MJBiz Factbook

Exclusive industry data and analysis to help you make informed business decisions and avoid costly missteps. All the facts, none of the hype.

What you will get:

- Monthly and quarterly updates, with new data & insights

- Financial forecasts + capital investment trends

- State-by-state guide to regulations, taxes & market opportunities

- Annual survey of cannabis businesses

- Consumer insights

- And more!

Where we go from here

What’s clear is that 280E is no longer a fringe policy debate. It’s a mainstream legal and financial issue affecting every one of the thousands of cannabis operators nationwide.

We don’t need to wait for courts or Congress to act. Operators can take steps now to understand their tax exposure, preserve their refund rights, and make informed decisions with the assistance of qualified professionals.

If we want a thriving, equitable, and sustainable cannabis industry, we need a tax code that reflects reality, not one that criminalizes compliance.

It’s time for the cannabis industry to stop absorbing 280E and start preparing to outlast it.

A former Big Four accountant, Naomi Granger, CPA, MBA, is the founder of National Association of Cannabis Accounting and Tax Professionals and a nationally recognized authority on cannabis tax strategy.

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.