Basket analysis, a common tool in traditional retail, is emerging as a key strategy in the cannabis industry.

By examining what products consumers purchase together during a visit, cannabis retailers and producers are gaining insights that go well beyond sales totals.

Basket data can help cannabis businesses understand shifting preferences, optimize store layouts and anticipate the next wave of consumer demand.

A new lens on cannabis buying habits

At its core, basket analysis tracks the combinations of products that end up in a single transaction.

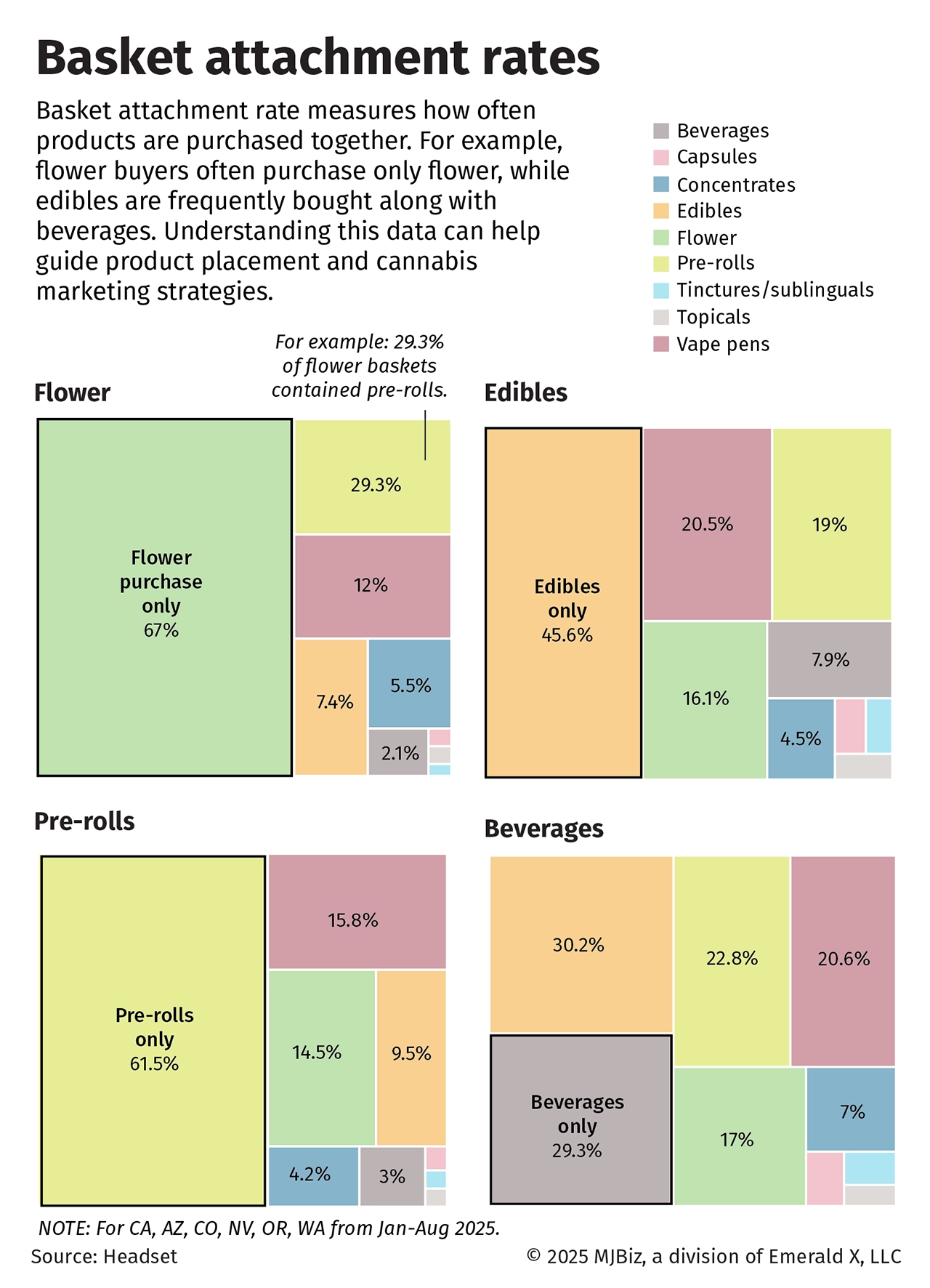

A basket attachment analysis published in the newly released Q3 edition of the MJBizFactbook, shows that cannabis flower buyers tend to make single-item purchases, while consumers of edibles often add beverages or vapes to their baskets.

The analysis of Western states in 2025 using data from cannabis industry analytics firm Headset found that 67% of marijuana flower buyers purchased only flower, while 45% of edibles buyers bought only edibles.

And beverage buyers more often purchase with edibles rather than buying beverages alone.

Such information sheds light on both consumer loyalty and experimentation, offering a snapshot of how shoppers approach retailer shelves.

Basket analysis allows operators to see whether customers are building consistent patterns or drifting toward variety.

For example, a consumer who buys the same brand of gummies every visit signals loyalty, while another who mixes flower with multiple infused products suggests a more exploratory approach.

Both patterns matter for inventory planning and promotional campaigns.

Implications for cannabis retail strategy

For cannabis retailers, basket analysis is a tool to increase sales and improve the customer experience.

If data shows that vape cartridges are often purchased with edibles, retailers can design product placement to encourage that connection.

Bundled promotions can be built around the most common combinations, increasing basket size and margin.

The data also helps identify gaps. If pre-rolls rarely appear in mixed baskets, it may suggest they are treated as a stand-alone purchase, calling for different merchandising strategies.

Likewise, if concentrates are consistently tied to certain accessories, cannabis retailers can stock and display those items together, improving convenience and boosting add-on sales.

As margins remain tight across the cannabis industry, the ability to turn existing foot traffic into larger basket sizes is a powerful lever.

Retailers are also using basket data to create targeted loyalty programs, suggest complementary products at checkout and even refine e-commerce recommendations.

Average basket sizes vary

Average basket sizes in cannabis retail vary widely not just across retailers but also in state markets as regulations, product availability and consumer habits shape spending.

In newer markets such as New York and New Jersey, limited product categories and higher prices often result in larger average baskets.

Mature markets like Colorado and Oregon, where competition is strong and selection broad, typically see smaller baskets as consumers make more frequent, lower-dollar purchases.

Tax policies, purchase limits and local preferences further influence spending patterns, underscoring how state-level rules drive significant differences in the average amount shoppers spend at checkout.

Producers take note

Producers are also watching basket analysis closely. Knowing that certain categories naturally pair together informs product development and branding.

A beverage maker may decide to partner with an edibles company if data shows consumers are already linking the two at retail.

Strains that sell well alongside infused products can be marketed with cross-promotional campaigns.

This information is particularly valuable in crowded markets where shelf space is limited.

If a brand can demonstrate that its product reliably boosts the value of a customer’s basket, it has leverage with retail buyers.

Producers who understand not just their own sales but how they fit into the broader shopping trip have an advantage when competing for placement.

Evolving consumer behavior

Basket analysis also reveals how cannabis consumers are evolving over time.

Early in cannabis legalization, many shoppers purchased a single familiar product, often flower.

As the market has matured, baskets have diversified.

Consumers are more willing to mix forms, whether adding a drink for social occasions or a topical for wellness.

This shift underscores the broader story of cannabis retail: loyalty to product type often outweighs loyalty to brand.

Basket analysis captures that reality in real time, showing how consumers prioritize experience, convenience and availability.

As new formats enter the market, the data will continue to highlight adoption rates and potential growth categories.

The secret to cannabis industry growth

In a more data-driven future, basket analysis is becoming a standard part of the toolkit for cannabis operators.

It helps retailers fine-tune operations and gives producers a clearer picture of consumer behavior.

Subscribe to the MJBiz Factbook

Exclusive industry data and analysis to help you make informed business decisions and avoid costly missteps. All the facts, none of the hype.

What you will get:

- Monthly and quarterly updates, with new data & insights

- Financial forecasts + capital investment trends

- State-by-state guide to regulations, taxes & market opportunities

- Annual survey of cannabis businesses

- Consumer insights

- And more!

Most importantly, it provides a bridge between raw sales data and the nuanced choices consumers make when standing at the counter or scrolling online menus.

In an industry defined by rapid change, basket analysis offers rare clarity.

It shows not just what people are buying but how they think about cannabis as part of their lifestyle.

For companies willing to act on those insights, it may prove to be one of the most valuable tools for growth.

Andrew Long can be reached at andrew.long@mjbizdaily.com.

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.