Colorado and Washington State took in more revenue from marijuana sales than from either alcohol or cigarettes in Fiscal Year 2022, according to a new report.

Another eight states saw tax revenue from cannabis outpace cigarettes, while Nevada took in more from marijuana than alcohol.

The analysis, published by the Tax Policy Center on Wednesday, provides a comprehensive overview of the various tax models, revenue data and debates over the most effective tax regimes in states that have legalized cannabis.

Here’s highlights of what they found. First, states and localities tax marijuana by weight, sales price, potency, or some combination. pic.twitter.com/uXX91muaAq

— Tax Policy Center (@TaxPolicyCenter) September 28, 2022

Researchers Richard Auxier and Nikhita Airi said that while it’s difficult to draw generalizations about marijuana tax policy given the patchwork of state and local tax models, there are several trends that have arisen since jurisdictions started implementing legalization. One of those trends is that, as cannabis markets have expanded, the plant is often eclipsing alcohol and cigarettes in terms of revenue it generates for tax coffers.

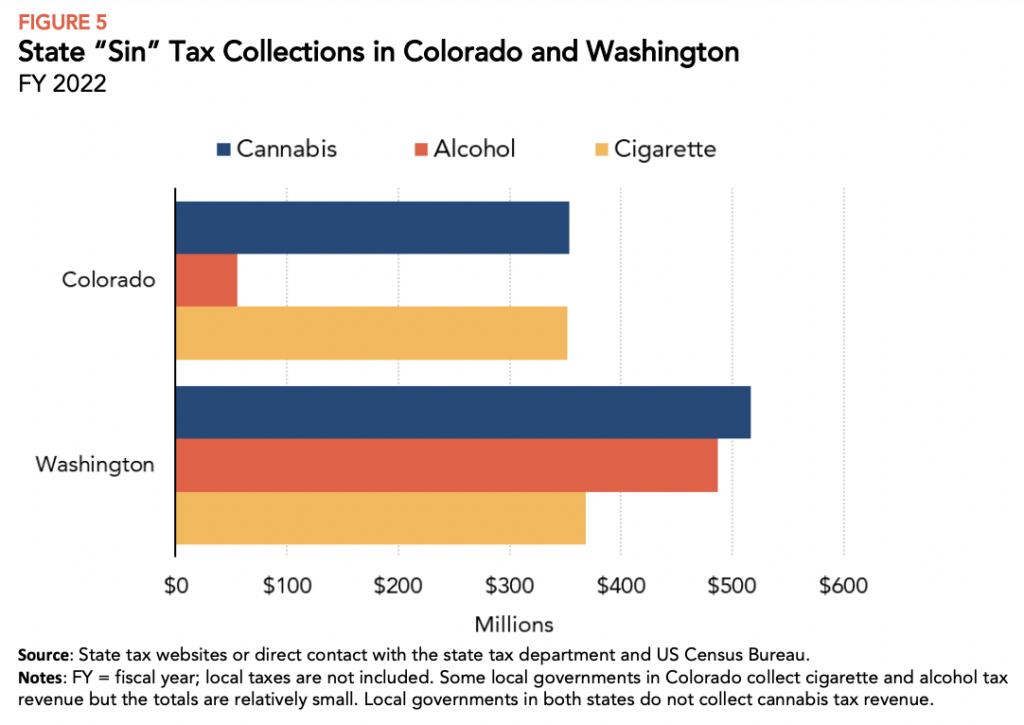

In Fiscal Year 2022, Colorado collected $353.7 million in marijuana tax dollars, just barely edging out cigarette tax revenue but nearly seven times more than what the state generated from alcohol excise taxes.

Via Tax Policy Center.

Washington State, meanwhile, took in $517 million in cannabis taxes, compared to about $490 million from alcohol and $380 from cigarettes.

This is all the more notable considering that tax revenue declined significantly in both Colorado and Washington State from the 2021 to 2022 fiscal year, at -14 percent and -7 percent, respectively.

The type of tax should align with the state’s goals. Some taxes maximize revenue, while others, such as a tax based on potency, are meant to discourage the use of more potent products. pic.twitter.com/BRpm4LYFep

— Tax Policy Center (@TaxPolicyCenter) September 28, 2022

“Broadly speaking, the experience of Colorado and Washington demonstrate that a state can collect a significant amount of revenue from marijuana taxes and that collection should mostly increase over time,” the report says.

The analysis further says that, “Among all 11 states that collected cannabis tax revenue for the entire 2022 fiscal year, eight collected more revenue from cannabis taxes than alcohol taxes.” And in addition to Colorado and Washington State, Nevada also brought in more from marijuana than cigarettes.

While the report looks at the full fiscal year totals, there are other examples of marijuana tax revenue beating out alcohol and tobacco in legal states over certain months or other periods of time.

In Arizona, for instance, the state generated more tax revenue to the general fund from legal marijuana sales than from tobacco and alcohol combined in March.

Massachusetts is collecting more tax revenue from marijuana than alcohol, state data released in January shows. As of December 2021, the state took in $51.3 million from alcohol taxes and $74.2 million from cannabis at the halfway point of the fiscal year.

Illinois also saw cannabis taxes beat out booze for the first time last year, with the state collecting about $100 million more from adult-use marijuana than alcohol during 2021.

In April, the Institute on Taxation and Economic Policy released an analysis that looked at 11 states that have legalized marijuana for adult use and found that, on average, “cannabis revenues outperformed alcohol by 20 percent” in 2021.

Advocates and stakeholders have touted these data points. Not only do they underscore the economic opportunity of legalization, but the hope is that providing regulated access to cannabis means fewer people will use more dangerous drugs like alcohol and tobacco.

A study published earlier this year found that marijuana legalization is associated with decreased use of alcohol, nicotine and non-prescription opioids among young adults.

More than twice as many Americans think that cannabis has a positive impact on its consumers and society at large than say the same about alcohol, a Gallup poll that was released last month found.

That’s generally consistent with the results of a separate poll released in March that found more Americans think it’d be good if people switched to cannabis and drank less alcohol compared to those who think the substance substitution would be bad.

USDA Touts Economic And Environmental Benefits Of Hemp As European Market Expands

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.