(This is the second installment of a two-part series exploring the wide-ranging effects of tariffs on the cannabis supply chain. Part 1 is available here.)

Cannabis companies and ancillary businesses are pivoting in real time to assess and respond to President Donald Trump’s fluctuating tariff policies in a sector reliant on a global supply chain primarily based outside the United States.

Despite the Trump administration’s policy efforts to revitalize U.S. manufacturing, the marijuana sector has found itself ill-equipped to handle increased demand in certain fulfillment areas, according to industry sources interviewed by MJBizDaily.

Amid these new challenges, cannabis companies aren’t rolling over in the face of the tariffs; rather, they are employing different strategies aimed to mitigate costs and further fallout without passing the buck to consumers.

But that might prove inevitable, industry observers said.

“The technology required to produce the vast amount of packaging needed to support a productive and compliant industry simply does not exist in the United States,” said John Hartsell, co-founder of Phoenix-based product packaging and logistics provider Dizpot.

Relocating production an option

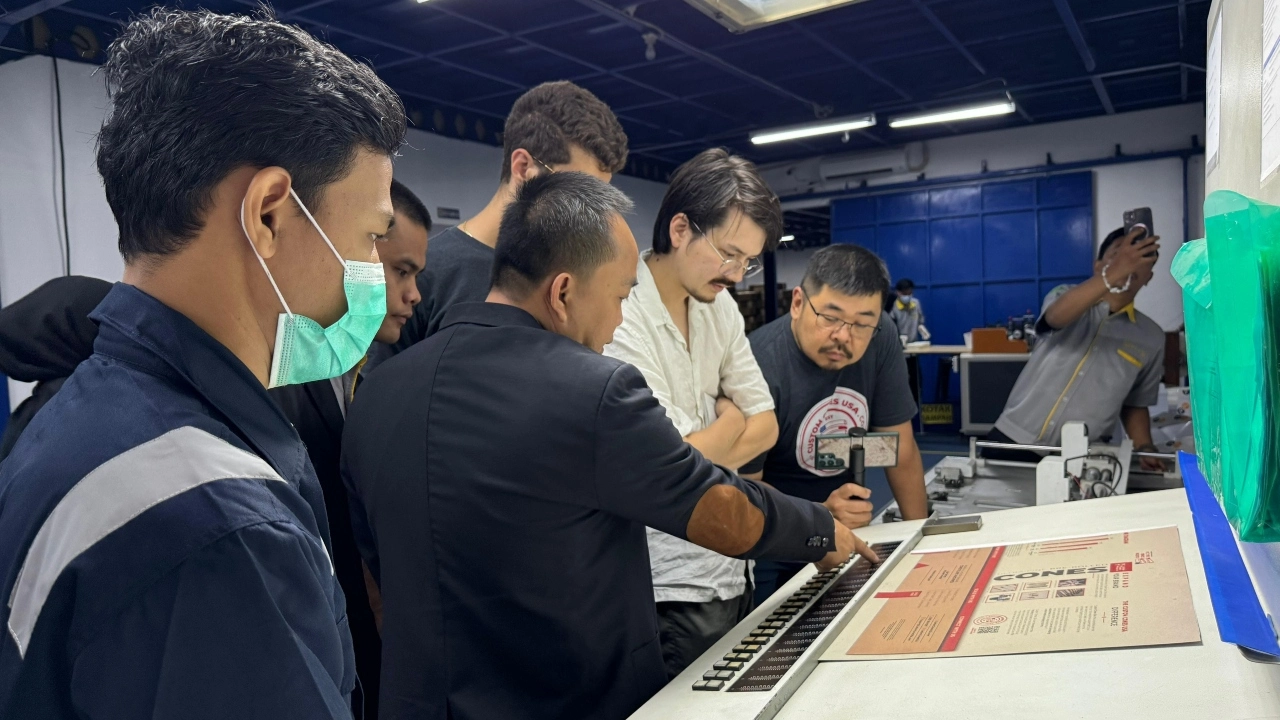

In response to the tariffs, Custom Cones USA moved production of plastic pre-roll tube packaging to the United States, where operational costs are on par with Chinese counterparts under the new trade policy.

The shift, according to Custom Cones co-founder and Chief Operating Officer Fredrik Rading, offers key advantages, including shortening the shipping time from two months to a few weeks, thereby reducing bulk ordering and warehousing.

However, the company’s core product lines – pre-roll cones and tubes – are manufactured in Indonesia and India, the global hubs for such products.

Custom Cones’ pre-roll machinery, glass tubes and packaging are made in China, which was hit with a 145% tariff on Thursday, a day after Trump announced a 90-day pause in so-called “reciprocal” duties levied on other countries.

The president’s blanket 10% tariff on all goods entering the U.S., which went into effect April 5, remains in place.

Renton, Washington-based Custom Cones has explored alternative production locations at its facilities in Taiwan and Indonesia.

But those markets lack the flexibility and infrastructure for small-volume, customized orders mastered by Chinese competitors on e-commerce marketplaces like Alibaba, Rading said.

Cones are typically priced in cents-per-unit and still produced by hand, constraints that make domestic production untenable, he argued.

“If these tariffs remain in place, the cost of pre-rolls will inevitably rise,” Rading said.

“Currently, there is no viable way to manufacture cones at scale in the U.S.”

Ispire Technology, the Los Angeles-based, cannabis-focused arm of e-cigarette company Aspire, has diverted some manufacturing from China to Malaysia, where it plans to build a second factory to accommodate 70 production lines, with some dedicated to cannabis vape products, MJBizDaily reported in March.

Ispire also is shifting product focus toward pod-based platforms.

“With pod systems the consumer is purchasing the battery once, eliminating the recurring cost and corresponding tariffs for the most expensive components of a vaporizer,” Dennis Lider, Ispire’s vice of president of cannabis, told MJBizDaily via email.

“There are residual benefits with pod systems as well: greater consumer value, operational efficiencies, and they’re better for the environment.”

Cannabis vendor and logistics response

Meanwhile, amid the strained political relations between the United States and Canada, Custom Cones is also dealing with backlash from partners on the other side of America’s northern border.

In some cases, the manufacturer has been downgraded as a preferred supplier, which means it will receive business only if top-tier contractors are out of stock.

To mitigate this development and tariffs, Custom Cones plans to open a distribution center in Canada that will import products directly from its Indonesian factory, Rading said.

As tariffs increase, input costs move downstream to logistics companies such as Philadelphia-based Talaria, which delivers, distributes and warehouses cannabis products in eight states.

The recent acquisition of Eagle Eyes Transportation provided Talaria inroads to Massachusetts, where the company will serve 300-plus cannabis retailers and nearly as many wholesalers.

Talaria is initiating several strategies to limit the financial impact on customers, including diversifying its supply chain with more domestic vendors, investing in better routing software and warehouse automation as well as exploring bundled-service offerings.

“Tariffs increase the need for precision in route planning, resource allocation and cost controls,” Talaria CEO Ari Raptis told MJBizDaily in a phone interview.

“Otherwise, your margins erode very, very fast.”

Despite efforts to mitigate customer pain points, the tariffs have generated new ones for Talaria as well.

The company, which operates a fleet of more than 100 vehicles, is in the process of ordering another 40 vehicles from European manufacturers.

“We don’t know what our pricing will be in six months, so it is challenging to handle our forecast and our growth because there are limitations on that as tariffs are put in,” Raptis said.

Consumers will feel impact

For its part, Dizpot plans to absorb the tariff impact to protect its customers from unexpected costs as it negotiates with vendors and through its trade groups in 10 states to ensure “consistent pricing, reliable delivery, and accessible turnaround times,” Hartsell added.

While tariffs are increasing costs for ZZZ’s Collective, the Massachusetts-based smoking accessories company is sticking with its international vendors and has no plans to raise prices, according to CEO Eric Sellew.

The company’s rolling papers, which are sold in more than 500 U.S. cannabis stores, are sourced from France.

ZZZ’s cones are hand-rolled in India, trays are made in China and the artist-designed packaging is hand-crafted in Slovenia.

“This decision does impact our gross margins, but we believe it’s the right move in the short term to prevent disruption and maintain customer trust and loyalty,” Sellew said.

Some operators indicated that consumers will ultimately feel the pinch as businesses pass along costs, particularly if the United States enters a recession.

Larry Fink, the CEO of New York-headquartered multinational investment-management corporation BlackRock, on Monday said that many business leaders already believe the economy is in a downturn, CNBC reported.

“It will be the end user, the consumer that will feel the increase,” said George Sadler, CEO of San Diego County-based Gelato Canna Co., which recently launched cannabis-infused gummies, vapes and edibles in 97 Arizona marijuana stores.

“We can only absorb so much in this volatile cannabis market.”

The company primarily relies on domestic suppliers for manufacturing and packaging, so it doesn’t expect tariffs to affect its business or operations, Sadler added.

Subscribe to the MJBiz Factbook

Exclusive industry data and analysis to help you make informed business decisions and avoid costly missteps. All the facts, none of the hype.

What you will get:

- Monthly and quarterly updates, with new data & insights

- Financial forecasts + capital investment trends

- State-by-state guide to regulations, taxes & market opportunities

- Annual survey of cannabis businesses

- Consumer insights

- And more!

Will tariffs benefit illicit marijuana operators?

Jeremy Zachary, CEO of Orange County, California-based infused marijuana products maker Zen Cannabis, said the tariffs. coupled with potential tax increases in the company’s home state, will lead more shoppers to unregulated suppliers.

“Driving consumers back to the black market will be an inevitable unintended consequence,” he predicted.

The tariff impact on cannabis vape companies might not be immediate, considering most stock inventory, but hard costs will eventually increase.

“This will trickle down to the cost the retailers pay and ultimately an increased cost on the consumer,” said Zachary Kobrin, a partner in the Fort Lauderdale, Florida, office of the Saul Ewing law firm and a former general council at multistate operator Trulieve Cannabis Corp.

Cannabis executive Jason Vedadi is bullish that some manufacturing, particularly packaging, will shift from Asia back to the United States as long as the tariffs remain.

“I’m more concerned about whether the consumer has less money because of this,” said Vedadi, the CEO of Phoenix-based Story Cannabis, which has retail stores and brands in Arizona, Maryland and Ohio.

“And then our sales go down.”

Chris Casacchia can be reached at chris.casacchia@mjbizdaily.com.

Medical Disclaimer:

The information provided in these blog posts is intended for general informational and educational purposes only. It is not a substitute for professional medical advice, diagnosis, or treatment. Always seek the advice of your physician or other qualified healthcare provider with any questions you may have regarding a medical condition. The use of any information provided in these blog posts is solely at your own risk. The authors and the website do not recommend or endorse any specific products, treatments, or procedures mentioned. Reliance on any information in these blog posts is solely at your own discretion.